Attorney-Approved Articles of Incorporation Form for Texas

Misconceptions

Understanding the Texas Articles of Incorporation is essential for anyone looking to establish a corporation in Texas. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important legal document.

- Misconception 1: The Articles of Incorporation are optional.

- Misconception 2: Only large businesses need to file Articles of Incorporation.

- Misconception 3: The process is the same in every state.

- Misconception 4: Articles of Incorporation are the same as a business license.

- Misconception 5: You can file Articles of Incorporation at any time.

- Misconception 6: You cannot amend Articles of Incorporation once filed.

- Misconception 7: Articles of Incorporation do not require any fees.

- Misconception 8: The Articles of Incorporation are only for for-profit businesses.

- Misconception 9: You can use a generic template for Articles of Incorporation.

- Misconception 10: Once filed, the Articles of Incorporation are never reviewed.

Incorporating a business in Texas requires filing Articles of Incorporation. This document is essential for establishing the corporation as a legal entity.

Regardless of size, any business intending to operate as a corporation must file Articles of Incorporation. This includes small businesses and startups.

Each state has its own requirements and procedures for filing Articles of Incorporation. Texas has specific forms and guidelines that must be followed.

While both are necessary for operating a business, Articles of Incorporation establish the corporation itself, whereas a business license allows for operation within a specific jurisdiction.

Filing must occur before the corporation can legally conduct business. Delaying this step can result in penalties or complications.

Amendments can be made to the Articles of Incorporation after filing. This flexibility allows for changes in business structure or purpose as needed.

There is a filing fee associated with submitting the Articles of Incorporation in Texas. This fee varies depending on the type of corporation being established.

Nonprofit organizations also need to file Articles of Incorporation. This is crucial for obtaining tax-exempt status and formal recognition.

While templates exist, it is important to ensure they meet Texas-specific requirements. Customizing the document according to state laws is essential.

The Texas Secretary of State reviews the filed Articles of Incorporation. They may request additional information or corrections if necessary.

What to Know About This Form

What is the Texas Articles of Incorporation form?

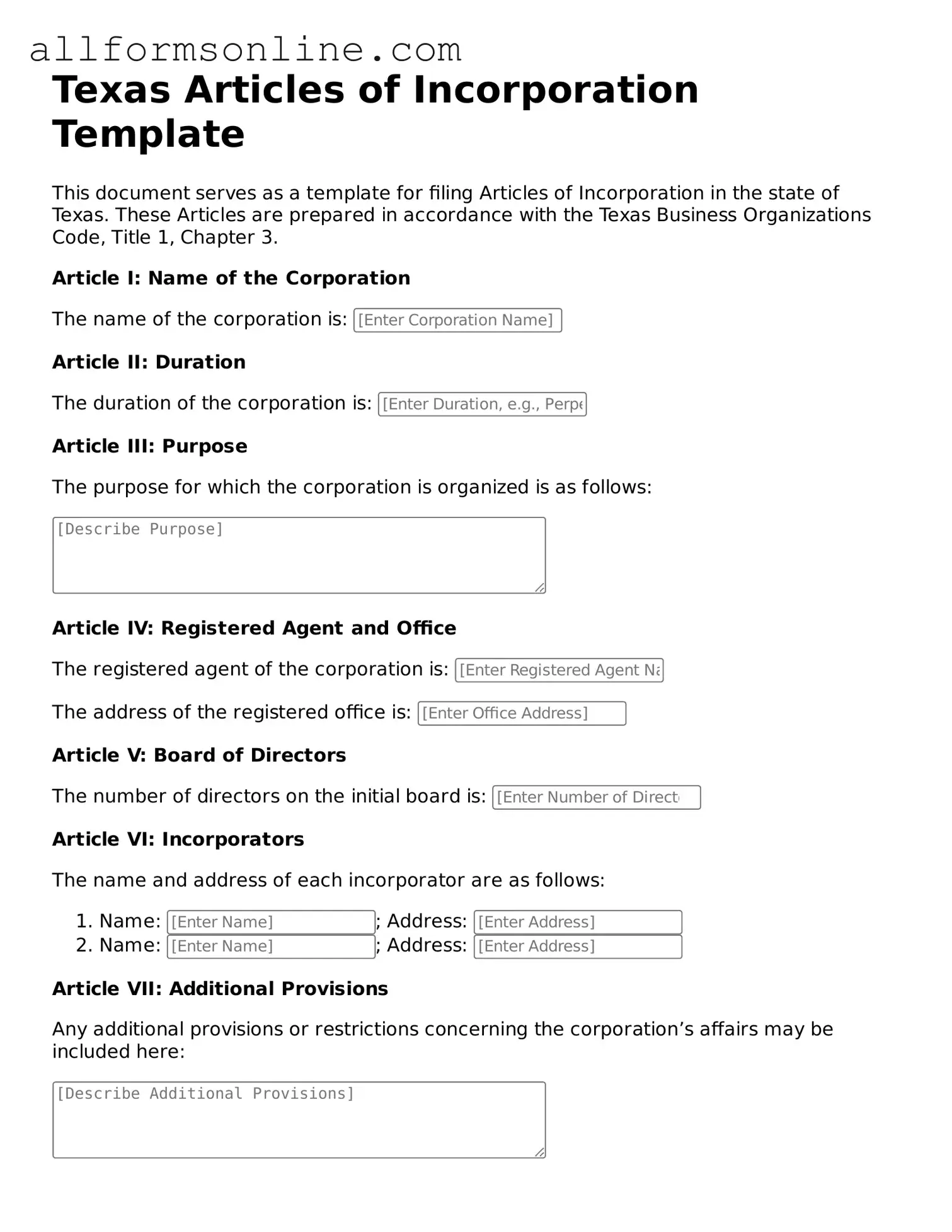

The Texas Articles of Incorporation form is a legal document that establishes a corporation in the state of Texas. This form outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the Texas Secretary of State is a crucial step in the incorporation process.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Texas must file the Articles of Incorporation. This includes businesses of all sizes, from small startups to large enterprises. Nonprofit organizations also need to complete this form to gain legal recognition.

What information is required on the form?

The form requires several key pieces of information. This includes the corporation's name, its duration (if not perpetual), the purpose of the corporation, the registered agent's name and address, and the number of shares the corporation is authorized to issue. Additionally, the names and addresses of the incorporators must be provided.

How much does it cost to file the Articles of Incorporation in Texas?

The filing fee for the Texas Articles of Incorporation is typically $300. However, this fee may vary based on the type of corporation being formed. Additional fees may apply if expedited processing is requested or if other services are required.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, it takes about 3 to 5 business days for the Texas Secretary of State to process the Articles of Incorporation. If expedited service is requested, the processing time may be reduced to 24 hours or less, depending on the chosen service level.

Can I file the Articles of Incorporation online?

Yes, Texas allows for online filing of the Articles of Incorporation through the Secretary of State's website. This method is often faster and more convenient than mailing a paper form. However, ensure that all required information is accurately provided to avoid delays.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation is officially formed. You will receive a certificate of incorporation as proof. After incorporation, it is essential to comply with ongoing requirements, such as holding annual meetings and filing annual reports, to maintain good standing.

Other Common State-specific Articles of Incorporation Forms

Florida Business Forms - The ability to amend governing documents is often detailed here.

Obtaining an Emotional Support Animal Letter is crucial for individuals who rely on animal companionship for their mental well-being, as it provides necessary documentation to facilitate reasonable housing and travel accommodations. For those navigating this process, resources like Fast PDF Templates can be incredibly helpful in ensuring that all requirements are met effectively.

Pennsylvania Corporation Bureau - Business owners may need to amend the articles over time.

Start Llc - Establishes a new corporation under state law.

How to Use Texas Articles of Incorporation

Once you have gathered all the necessary information, you can begin filling out the Texas Articles of Incorporation form. This document is essential for establishing your corporation in Texas. After completing the form, you will submit it to the Texas Secretary of State along with the required filing fee. Make sure to double-check your entries for accuracy to avoid delays in processing.

- Visit the Texas Secretary of State's website to access the Articles of Incorporation form.

- Choose the appropriate form based on your corporation type (e.g., for-profit or nonprofit).

- Provide the name of your corporation. Ensure it complies with Texas naming rules.

- Fill in the duration of your corporation. If you want it to exist indefinitely, state that explicitly.

- Enter the purpose of your corporation. Be clear and concise about your business activities.

- List the registered agent’s name and address. This person will receive legal documents on behalf of the corporation.

- Indicate the number of shares your corporation is authorized to issue, if applicable.

- Provide the names and addresses of the initial directors of your corporation.

- Include the name and address of the incorporator, who is responsible for filing the form.

- Sign and date the form. Ensure that the incorporator's signature is included.

- Review the completed form for any errors or omissions.

- Prepare the filing fee, which can vary based on the type of corporation.

- Submit the form and payment to the Texas Secretary of State, either online or by mail.