Attorney-Approved Bill of Sale Form for Texas

Misconceptions

Understanding the Texas Bill of Sale form can be challenging. Here are some common misconceptions about it:

- A Bill of Sale is only for vehicles. Many people believe this document is only necessary for cars or trucks. However, a Bill of Sale can be used for any personal property, including boats, furniture, and electronics.

- A Bill of Sale is not legally binding. Some think that a Bill of Sale has no legal standing. In Texas, this document can serve as proof of ownership and is legally recognized if properly filled out.

- You don't need a Bill of Sale if you have a title. While a title is important for vehicles, a Bill of Sale provides additional proof of the transaction and can be useful for tax purposes.

- All sales require notarization. Not all transactions need to be notarized in Texas. A Bill of Sale can be valid without a notary, but having one can add an extra layer of authenticity.

- A Bill of Sale must be filed with the state. Many believe they need to submit the Bill of Sale to a government office. In Texas, this is not required, but it is advisable to keep a copy for personal records.

- Only the buyer needs a copy of the Bill of Sale. This is incorrect. Both the buyer and seller should retain a copy of the Bill of Sale for their records.

- A Bill of Sale is only necessary for large transactions. This is a misconception. Even small sales benefit from having a Bill of Sale to document the exchange.

- You can't create your own Bill of Sale. Many think they must use a specific form. In Texas, you can create your own Bill of Sale as long as it includes the necessary information about the transaction.

What to Know About This Form

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one individual to another. This form is essential when buying or selling items such as vehicles, boats, or equipment. It outlines the details of the transaction, including the names of the buyer and seller, a description of the item, and the sale price. Having this document helps protect both parties by providing a record of the sale.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for every transaction in Texas, it is highly recommended, especially for significant purchases like vehicles. The Texas Department of Motor Vehicles requires a Bill of Sale for certain vehicle transactions to ensure proper registration and title transfer. Even for smaller items, having a Bill of Sale can help clarify ownership and prevent disputes in the future.

What information should be included in a Texas Bill of Sale?

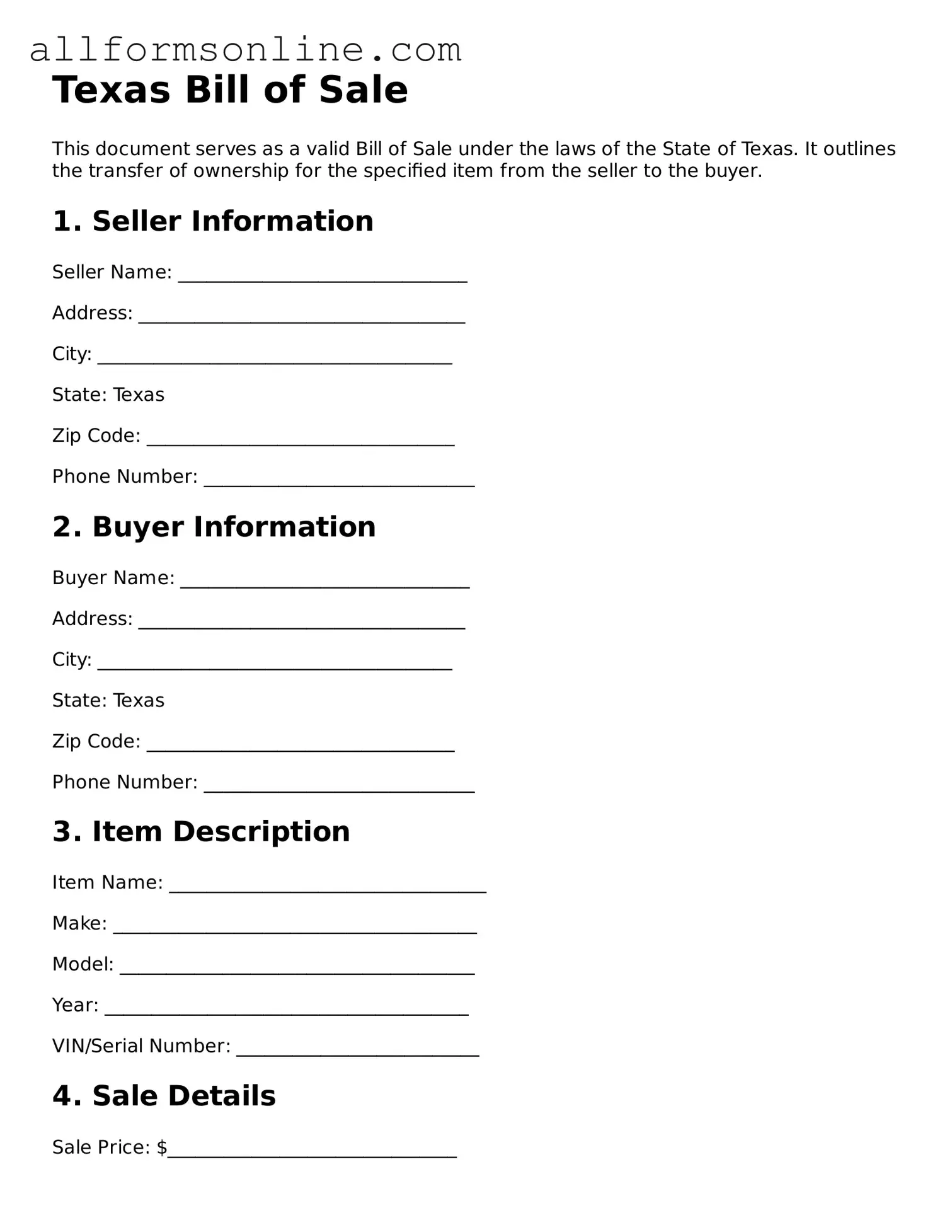

A comprehensive Texas Bill of Sale should include several key pieces of information. This includes the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including make, model, and serial number if applicable), the sale price, and the date of the transaction. It is also advisable to include a statement regarding the condition of the item and any warranties or guarantees provided.

Do I need to have the Bill of Sale notarized?

Notarization is not a requirement for a Bill of Sale in Texas, but it can add an extra layer of protection. Having the document notarized provides verification of the identities of the parties involved and the authenticity of their signatures. This can be particularly useful if any disputes arise later regarding the transaction.

Can a Bill of Sale be used for gifts or trades?

Yes, a Bill of Sale can also be used for gifts or trades. Even if no money changes hands, documenting the transfer of ownership through a Bill of Sale can be beneficial. It helps to clarify the intent of the parties involved and serves as a record of the transaction, which can be useful for tax purposes or in case of future disputes.

Where can I obtain a Texas Bill of Sale form?

Texas Bill of Sale forms can be easily obtained from various sources. Many online legal service websites provide free or low-cost templates that can be customized to fit your needs. Additionally, local offices, such as the county clerk or the Department of Motor Vehicles, may offer official forms. It is important to ensure that any form you use complies with Texas laws and includes all necessary information.

Other Common State-specific Bill of Sale Forms

Free Vehicle Bill of Sale Template - The Bill of Sale can mitigate tax liability for both parties involved.

The Employment Verification Form is a document used to confirm a person's employment status, title, and duration of employment at a particular company. Employers often request this form during background checks or when applying for loans or rental agreements. By providing accurate information, the form ensures that the employment history presented by an applicant is legitimate and reliable. For those looking for a convenient template to use, Fast PDF Templates offers a comprehensive solution.

Format for Bill of Sale - It may be used in both private sales and commercial transactions.

How to Use Texas Bill of Sale

Once you have the Texas Bill of Sale form in front of you, it's time to complete it. This document will serve as proof of the transaction between the buyer and seller. Follow these steps to ensure that all necessary information is included accurately.

- Identify the Parties: Write the full name and address of both the seller and the buyer. This establishes who is involved in the transaction.

- Describe the Item: Clearly describe the item being sold. Include details like the make, model, year, and any identification numbers, such as a Vehicle Identification Number (VIN) if applicable.

- State the Sale Price: Indicate the agreed-upon sale price. This is the amount the buyer will pay to the seller.

- Include Date of Sale: Write the date when the transaction takes place. This is important for record-keeping purposes.

- Signatures: Both the seller and the buyer must sign the form. This signifies that both parties agree to the terms outlined in the Bill of Sale.

- Notarization (if required): Depending on the item being sold, you may need to have the form notarized. Check local requirements to see if this step is necessary.

After completing these steps, ensure that both parties keep a copy of the signed Bill of Sale for their records. This document can be essential for future reference, especially for ownership verification or if any disputes arise.