Attorney-Approved Deed in Lieu of Foreclosure Form for Texas

Misconceptions

Understanding the Texas Deed in Lieu of Foreclosure can help homeowners navigate challenging situations. However, several misconceptions often arise regarding this process. Below is a list of common misunderstandings along with clarifications.

- It eliminates all debts associated with the mortgage. Many believe that signing a Deed in Lieu automatically wipes out all mortgage-related debts. However, this is not always the case. The lender may still pursue other debts if they exceed the property's value.

- It guarantees a smooth transition to a new home. While a Deed in Lieu may ease the foreclosure process, it does not guarantee immediate housing solutions. Homeowners must still find alternative living arrangements.

- All lenders accept a Deed in Lieu of Foreclosure. Some lenders may not accept this option. Each lender has its own policies, and it is essential to communicate directly with them to understand available options.

- It is a quick and easy process. Although a Deed in Lieu can be less time-consuming than foreclosure, it still requires careful documentation and negotiation. Homeowners should be prepared for potential delays.

- It has no impact on credit scores. A Deed in Lieu of Foreclosure can negatively affect credit scores, similar to a foreclosure. It is crucial to understand the potential long-term effects on creditworthiness.

- Homeowners can remain in their homes after signing. Once the Deed in Lieu is executed, the lender typically takes possession of the property. Homeowners should not expect to stay in the home without an agreement.

- It is the only option for distressed homeowners. While a Deed in Lieu may be a viable option, it is not the only one. Alternatives such as loan modifications or short sales may also be available and should be explored.

- Legal assistance is not necessary. Some homeowners believe they can navigate the process independently. However, seeking legal advice can provide valuable insights and protect their interests.

- It is a permanent solution to financial problems. A Deed in Lieu of Foreclosure addresses the immediate issue of foreclosure but does not resolve underlying financial difficulties. Homeowners should consider comprehensive financial planning for long-term stability.

Addressing these misconceptions can empower homeowners to make informed decisions during a difficult time. Seeking guidance from professionals can also provide clarity and support throughout the process.

What to Know About This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement between a borrower and a lender. In this arrangement, the borrower voluntarily transfers the ownership of their property to the lender to avoid the lengthy and costly foreclosure process. Essentially, the borrower gives up their rights to the property in exchange for the lender canceling the mortgage debt. This can be a beneficial option for homeowners facing financial difficulties.

How does a Deed in Lieu of Foreclosure work in Texas?

In Texas, the process begins when the homeowner and lender agree to the Deed in Lieu of Foreclosure. The homeowner must provide the lender with a written request, along with any necessary documentation. After reviewing the request, the lender may accept the deed, allowing the borrower to transfer ownership. Once the deed is signed and recorded, the lender takes possession of the property, and the mortgage debt is typically forgiven.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to choosing a Deed in Lieu of Foreclosure. First, it can save time and money compared to a traditional foreclosure. The process is usually quicker and less expensive for both parties. Second, it allows the homeowner to avoid the negative impact of a foreclosure on their credit report. Lastly, the borrower may be able to negotiate terms with the lender, such as the forgiveness of some debt or assistance in finding new housing.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential downsides. For instance, not all lenders accept a Deed in Lieu of Foreclosure, so homeowners may need to negotiate. Additionally, the homeowner may still face tax implications, as forgiven debt can sometimes be considered taxable income. Furthermore, the process may not be suitable for those who have significant equity in their home, as the lender may prefer to pursue foreclosure to recover their investment.

Can I change my mind after signing a Deed in Lieu of Foreclosure?

Once the Deed in Lieu of Foreclosure is signed and recorded, it is generally considered final. This means that the homeowner cannot change their mind without the lender's agreement. It is crucial to fully understand the implications and consequences before entering into this agreement. Consulting with a legal professional can provide clarity and help homeowners make informed decisions.

What documentation is needed for a Deed in Lieu of Foreclosure?

The required documentation may vary by lender, but typically, homeowners will need to provide proof of income, a hardship letter explaining their situation, and financial statements. Additionally, the lender may request a copy of the mortgage agreement and any other relevant documents. Preparing these materials in advance can help streamline the process and increase the likelihood of approval.

How can I find out if a Deed in Lieu of Foreclosure is right for me?

Determining if a Deed in Lieu of Foreclosure is the right choice involves evaluating your financial situation and discussing options with a knowledgeable professional. A housing counselor or attorney can help assess your circumstances and provide guidance on the best course of action. It’s important to consider all alternatives, including loan modifications or short sales, to make an informed decision that aligns with your needs.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Pa - Deed in Lieu agreements can sometimes lead to less foreclosure-related stigma among potential future lenders.

The California Release of Liability form is a legal document that helps protect individuals and organizations from being held responsible for injuries or damages that may occur during certain activities. Typically used in recreational settings or events, this form outlines the risks involved and requires participants to acknowledge and accept those risks. Understanding this form is crucial for anyone seeking to participate in activities where liability concerns may arise, and for more information, you can refer to Fast PDF Templates.

California Pre-foreclosure Property Transfer - The use of a Deed in Lieu is often dependent on the lender's acceptance of the offer.

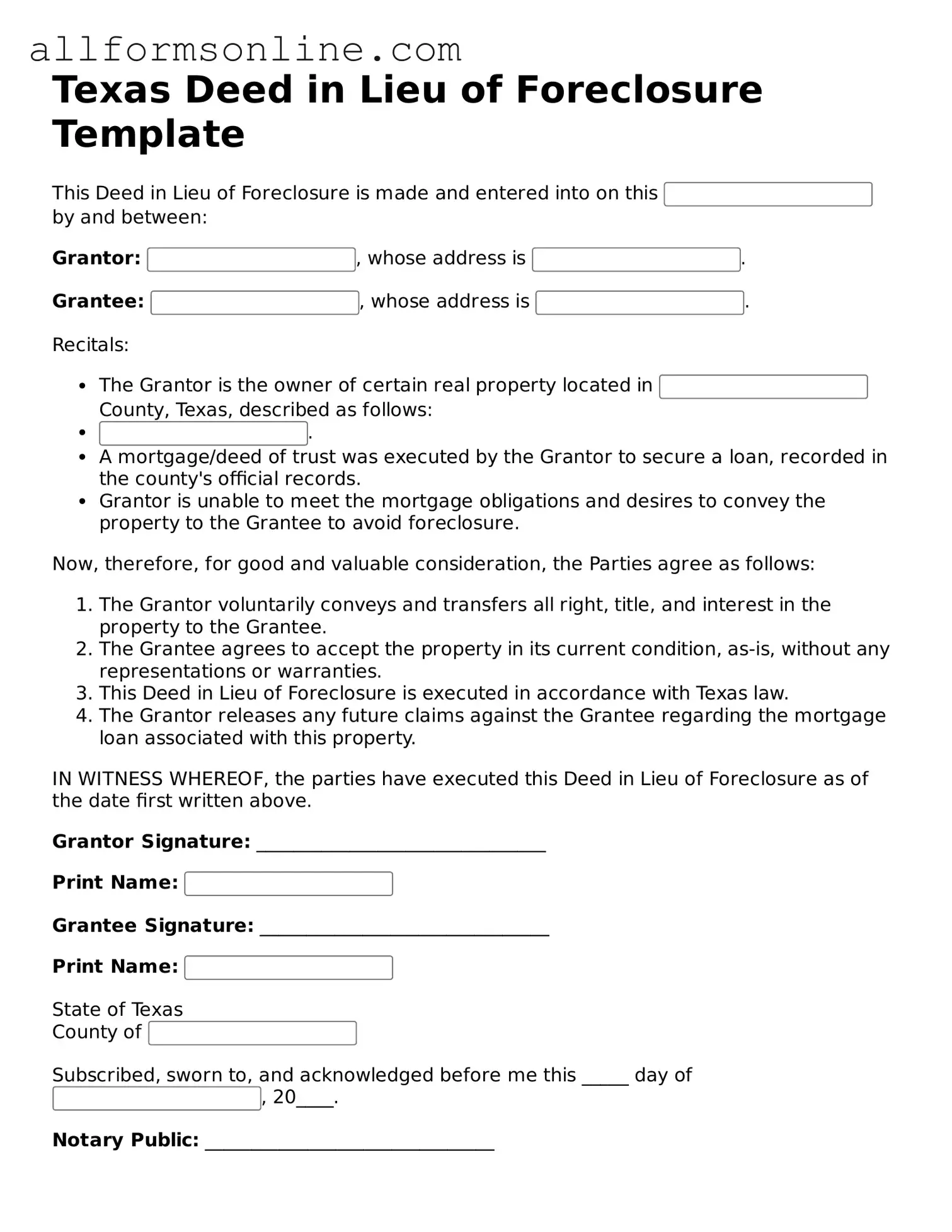

How to Use Texas Deed in Lieu of Foreclosure

Once you have decided to proceed with a Deed in Lieu of Foreclosure in Texas, it’s important to fill out the form accurately. This process can help you transfer the property back to the lender and may provide you with a fresh start. Following the steps below will guide you through completing the form correctly.

- Obtain the Form: Start by downloading or requesting the Texas Deed in Lieu of Foreclosure form from your lender or a reliable legal resource.

- Property Information: Fill in the property address, including the city, state, and zip code. Ensure that the details match the information on your mortgage documents.

- Grantor Information: Enter your name as the current property owner (the grantor). If there are multiple owners, include all names as they appear on the title.

- Grantee Information: Provide the name of the lender or financial institution receiving the property (the grantee). This should also match the information in your mortgage documents.

- Legal Description: Include the legal description of the property. This is often found on your deed or mortgage documents and may include lot numbers or metes and bounds.

- Consideration: State that the deed is given in lieu of foreclosure. You may also need to indicate any specific terms agreed upon with the lender.

- Signatures: Sign and date the form. Ensure that all grantors (property owners) sign, as required. If applicable, have the signatures notarized to validate the document.

- Submit the Form: Send the completed form to your lender and keep a copy for your records. Confirm with the lender that they have received it and ask about any next steps.

After submitting the Deed in Lieu of Foreclosure form, the lender will review the document and may contact you for further information. Be prepared for any follow-up discussions regarding the transfer process and any potential implications for your credit and future homeownership.