Attorney-Approved Durable Power of Attorney Form for Texas

Misconceptions

Understanding the Texas Durable Power of Attorney form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- Misconception 1: A Durable Power of Attorney is only for elderly individuals.

- Misconception 2: The agent can do anything they want with my assets.

- Misconception 3: A Durable Power of Attorney automatically ends when I become incapacitated.

- Misconception 4: I cannot revoke a Durable Power of Attorney once it is created.

- Misconception 5: A Durable Power of Attorney is the same as a living will.

This is not true. A Durable Power of Attorney can be beneficial for anyone, regardless of age. It allows individuals to designate someone to manage their financial or medical decisions if they become incapacitated.

While the agent does have significant authority, they are legally obligated to act in the best interest of the principal. The powers granted can be limited or specific, depending on the principal's wishes.

This is incorrect. The term "durable" means that the power of attorney remains in effect even if the principal becomes incapacitated. This is a key feature that distinguishes it from a regular power of attorney.

In fact, a Durable Power of Attorney can be revoked at any time, as long as the principal is mentally competent. It is important to provide written notice to the agent and any relevant third parties to ensure the revocation is recognized.

This is a common misunderstanding. A Durable Power of Attorney focuses on financial and legal decisions, while a living will specifically addresses healthcare decisions and end-of-life care. They serve different purposes in estate planning.

What to Know About This Form

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so. This can include decisions about financial matters, property management, and other personal affairs. The "durable" aspect means that the authority granted to your agent continues even if you become incapacitated.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney can provide peace of mind. It ensures that your financial and personal affairs will be managed by someone you trust, rather than leaving those decisions to the court or relying on state laws. This document can help avoid potential conflicts among family members and can streamline decision-making during difficult times.

Who can I appoint as my agent?

You can appoint any competent adult as your agent. This could be a family member, friend, or a trusted advisor. It's important to choose someone who is responsible and understands your values and wishes. You can also designate alternate agents in case your first choice is unable or unwilling to serve.

What powers can I grant to my agent?

You have the flexibility to grant a wide range of powers to your agent, including managing bank accounts, paying bills, selling property, and handling investments. You can also specify limitations on these powers if you wish. The key is to clearly outline what your agent can and cannot do in the document.

Do I need to have my Durable Power of Attorney notarized?

Yes, in Texas, your Durable Power of Attorney must be signed in the presence of a notary public to be legally valid. This step adds an extra layer of authenticity to the document and helps prevent potential disputes about its validity in the future.

Can I revoke or change my Durable Power of Attorney once it’s created?

Absolutely. You have the right to revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written document stating your intent to revoke the previous power of attorney and notify your agent and any institutions that may have a copy of the original document.

What happens if I don’t have a Durable Power of Attorney?

If you become incapacitated and do not have a Durable Power of Attorney in place, your loved ones may need to go through a court process to obtain guardianship or conservatorship. This can be time-consuming, costly, and may not reflect your wishes. Having a Durable Power of Attorney can help avoid this scenario and ensure your preferences are respected.

When does a Durable Power of Attorney take effect?

A Durable Power of Attorney can take effect immediately upon signing or can be set to activate upon a specific event, such as your incapacitation. If you choose the latter option, it’s important to clearly outline the criteria for activation in the document to avoid confusion later on.

Other Common State-specific Durable Power of Attorney Forms

How to Get Power of Attorney Florida - Effective even if the principal becomes incapacitated.

This document plays a vital role for landlords needing guidance on the eviction process, especially when it comes to a "Notice to Quit" which outlines the formal request for tenants to vacate. For further reference, consider the necessary steps associated with the Notice to Quit process.

Power of Attorney Form Pennsylvania - It is essential to choose a trusted individual as your agent when completing this form.

Durable Power of Attorney Pdf - Consider discussing your choices with your family when designating an agent.

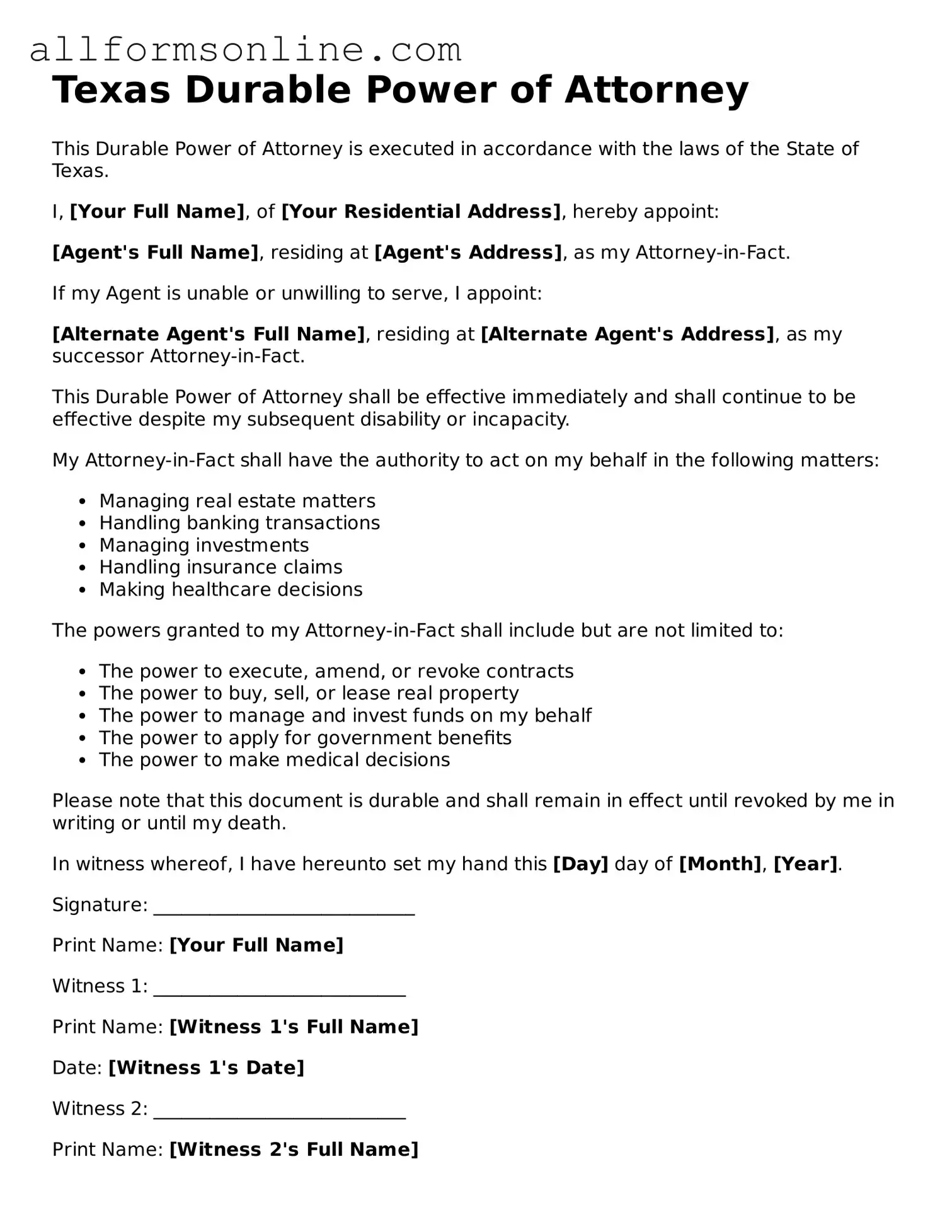

How to Use Texas Durable Power of Attorney

Completing the Texas Durable Power of Attorney form requires careful attention to detail. Once the form is filled out correctly, it will need to be signed and witnessed to ensure its validity. Below are the steps to guide you through the process of filling out the form.

- Obtain the Texas Durable Power of Attorney form. You can find it online or at a legal office.

- Begin by filling in your full name and address in the designated section. This identifies you as the principal.

- Next, specify the name and address of the agent you are appointing. This individual will act on your behalf.

- Clearly outline the powers you wish to grant to your agent. You can choose general powers or specify particular actions.

- If desired, indicate any limitations or special instructions regarding the powers granted.

- Include the date on which the powers will begin. You may choose to have them effective immediately or at a future date.

- Sign the document in the presence of a notary public. Ensure the notary signs and seals the form as required.

- Have two witnesses sign the form, if necessary. They should not be related to you or the agent.

- Keep a copy of the completed and signed form for your records. Provide copies to your agent and any relevant parties.