Attorney-Approved Gift Deed Form for Texas

Misconceptions

Understanding the Texas Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- A Gift Deed is the same as a Sale Deed. Many people believe that a Gift Deed functions like a Sale Deed. In reality, a Gift Deed transfers property without any exchange of money, while a Sale Deed involves a financial transaction.

- A Gift Deed must be notarized to be valid. Some individuals think that notarization is optional. In Texas, while it is advisable to have a Gift Deed notarized for it to be enforceable, the law does not strictly require it. However, notarization helps establish authenticity and can prevent disputes.

- You can revoke a Gift Deed at any time. There is a belief that once a Gift Deed is signed, it can be easily undone. In Texas, a Gift Deed is generally irrevocable once it has been executed and delivered, unless specific conditions are included that allow for revocation.

- Gift Deeds do not require any formalities. Some think that creating a Gift Deed is a simple process without any legal requirements. However, it must be in writing, signed by the donor, and typically requires proper documentation to ensure that the transfer is legally recognized.

- There are no tax implications for a Gift Deed. Many assume that gifting property is tax-free. While there may be no immediate income tax implications, the donor may still be subject to gift taxes depending on the value of the property transferred, and the recipient may face capital gains tax if they sell the property later.

By clarifying these misconceptions, individuals can better navigate the process of gifting property in Texas and ensure that their intentions are legally recognized and protected.

What to Know About This Form

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. It is often used when a property owner wishes to give a gift of real estate to a family member or friend.

What information is required to complete a Gift Deed?

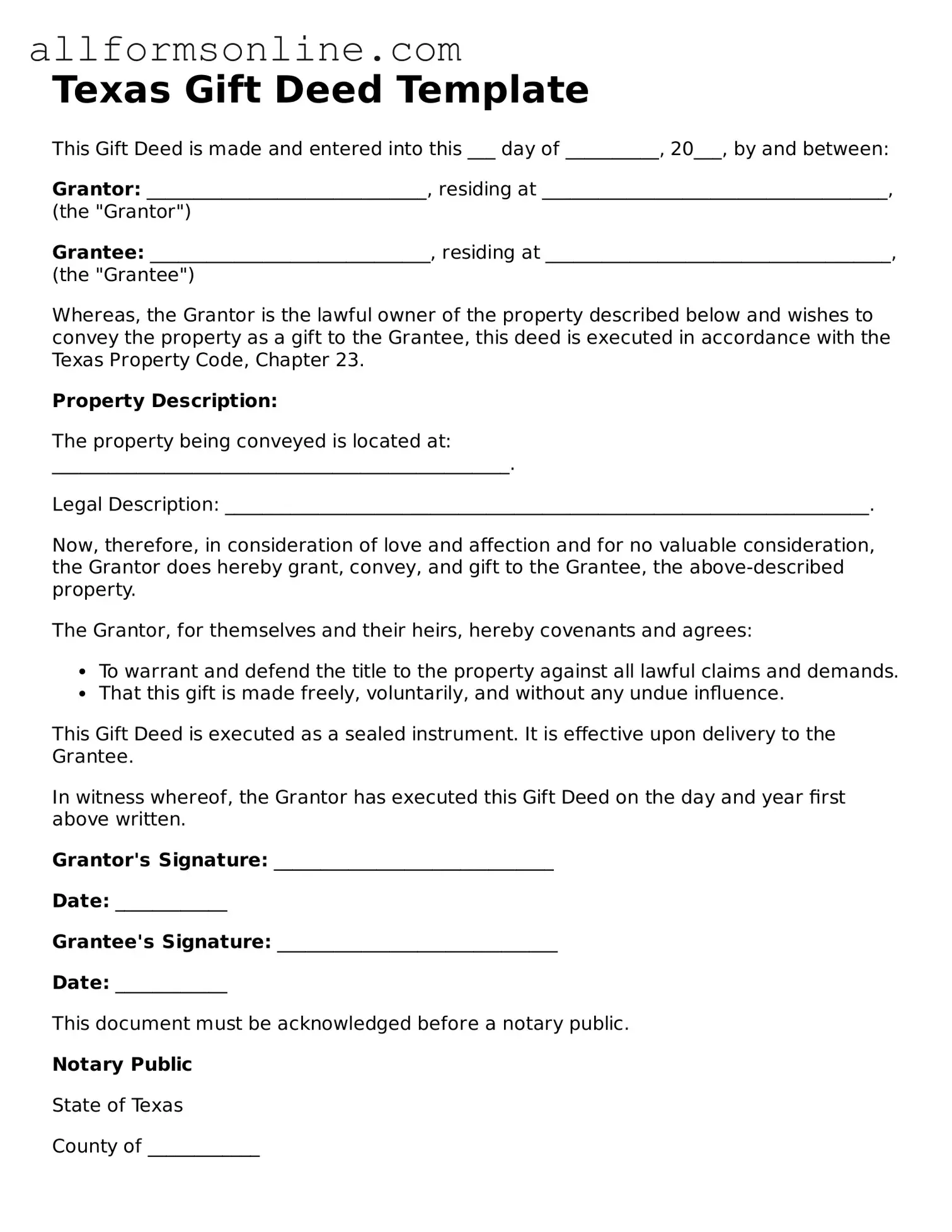

To complete a Gift Deed, you will need the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift). Additionally, a legal description of the property being transferred is necessary, along with the county where the property is located.

Do I need to have the Gift Deed notarized?

Yes, a Gift Deed must be notarized to be legally valid in Texas. The donor must sign the deed in front of a notary public, who will then affix their seal to the document. This step helps to ensure the authenticity of the signatures.

Is there a tax implication when giving a property as a gift?

While the recipient of the gift does not have to pay taxes at the time of receiving the property, the donor may be subject to gift tax if the value of the property exceeds the annual exclusion limit set by the IRS. It is advisable to consult a tax professional for specific guidance.

Can I revoke a Gift Deed after it has been executed?

Once a Gift Deed is executed and delivered to the recipient, it generally cannot be revoked. The transfer of ownership is considered final. However, if there are specific conditions stated in the deed, those may allow for certain actions. Consulting an attorney is recommended for any concerns regarding revocation.

How is a Gift Deed different from a Sale Deed?

A Gift Deed transfers property without any payment, while a Sale Deed involves a transaction where the buyer pays the seller. The primary difference lies in the consideration; a Gift Deed is a gift, whereas a Sale Deed is a sale.

Do I need an attorney to prepare a Gift Deed?

While it is not legally required to have an attorney prepare a Gift Deed, it is often beneficial. An attorney can ensure that the document is correctly drafted and complies with Texas laws, reducing the risk of future disputes.

What happens if the Gift Deed is not recorded?

If a Gift Deed is not recorded with the county clerk, the transfer of ownership may not be recognized against third parties. Recording the deed provides public notice of the change in ownership and protects the recipient's interest in the property.

Can a Gift Deed be used for personal property as well?

While a Gift Deed is specifically designed for real property, personal property can also be gifted using a different type of document, often referred to as a Bill of Sale. Each type of transfer document serves its specific purpose based on the nature of the property.

What should I do after completing a Gift Deed?

After completing a Gift Deed, the next step is to have it notarized and then recorded with the appropriate county clerk's office. This ensures that the transfer is legally recognized and provides a public record of the ownership change.

Other Common State-specific Gift Deed Forms

How to Add Someone to House Title in California - Properly documenting a gift with a Gift Deed can provide peace of mind to both the giver and receiver.

The California Release of Liability form is a legal document that helps protect individuals and organizations from being held responsible for injuries or damages that may occur during certain activities. Typically used in recreational settings or events, this form outlines the risks involved and requires participants to acknowledge and accept those risks. For more information on how to create this essential document, visit Fast PDF Templates, which provides helpful resources on liability waivers.

How to Use Texas Gift Deed

After completing the Texas Gift Deed form, it will need to be signed and notarized. Once this is done, the document should be filed with the county clerk's office where the property is located. This will officially record the transfer of property ownership.

- Obtain the Texas Gift Deed form. You can find it online or at a local office supply store.

- Fill in the names and addresses of the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Provide a legal description of the property being gifted. This information can typically be found on the property’s deed or tax records.

- Include the county where the property is located.

- Indicate the date of the gift.

- Sign the form in front of a notary public. Ensure that both the donor and recipient are present for this step.

- Make copies of the signed and notarized deed for your records.

- File the original deed with the county clerk's office in the appropriate county.