Attorney-Approved Golf Cart Bill of Sale Form for Texas

Misconceptions

Understanding the Texas Golf Cart Bill of Sale form can be challenging due to various misconceptions. Here are eight common misunderstandings related to this document:

- It is not necessary to have a Bill of Sale for golf carts. Many people believe that a Bill of Sale is optional, but it is important for documenting the transaction and providing proof of ownership.

- All golf carts require registration in Texas. While some golf carts must be registered, others do not, particularly if they are used solely on private property.

- A Bill of Sale must be notarized. Notarization is not a requirement for a Bill of Sale in Texas, although it may provide an additional layer of security for the buyer.

- The form must be filled out by a legal professional. Individuals can complete the Bill of Sale without legal assistance, as the form is straightforward and designed for easy use.

- Only new golf carts need a Bill of Sale. Both new and used golf carts require a Bill of Sale to document the transfer of ownership.

- The seller must provide a warranty on the golf cart. A Bill of Sale does not imply any warranty unless explicitly stated. It is typically sold as-is.

- There is a specific state-mandated format for the Bill of Sale. While it should include essential information, there is flexibility in how the form is structured, as long as it meets the necessary criteria.

- Buying a golf cart is the same as buying a car. While there are similarities, the regulations and requirements for golf carts are often less stringent than those for automobiles.

By addressing these misconceptions, individuals can navigate the process of buying or selling a golf cart in Texas more effectively.

What to Know About This Form

What is a Texas Golf Cart Bill of Sale?

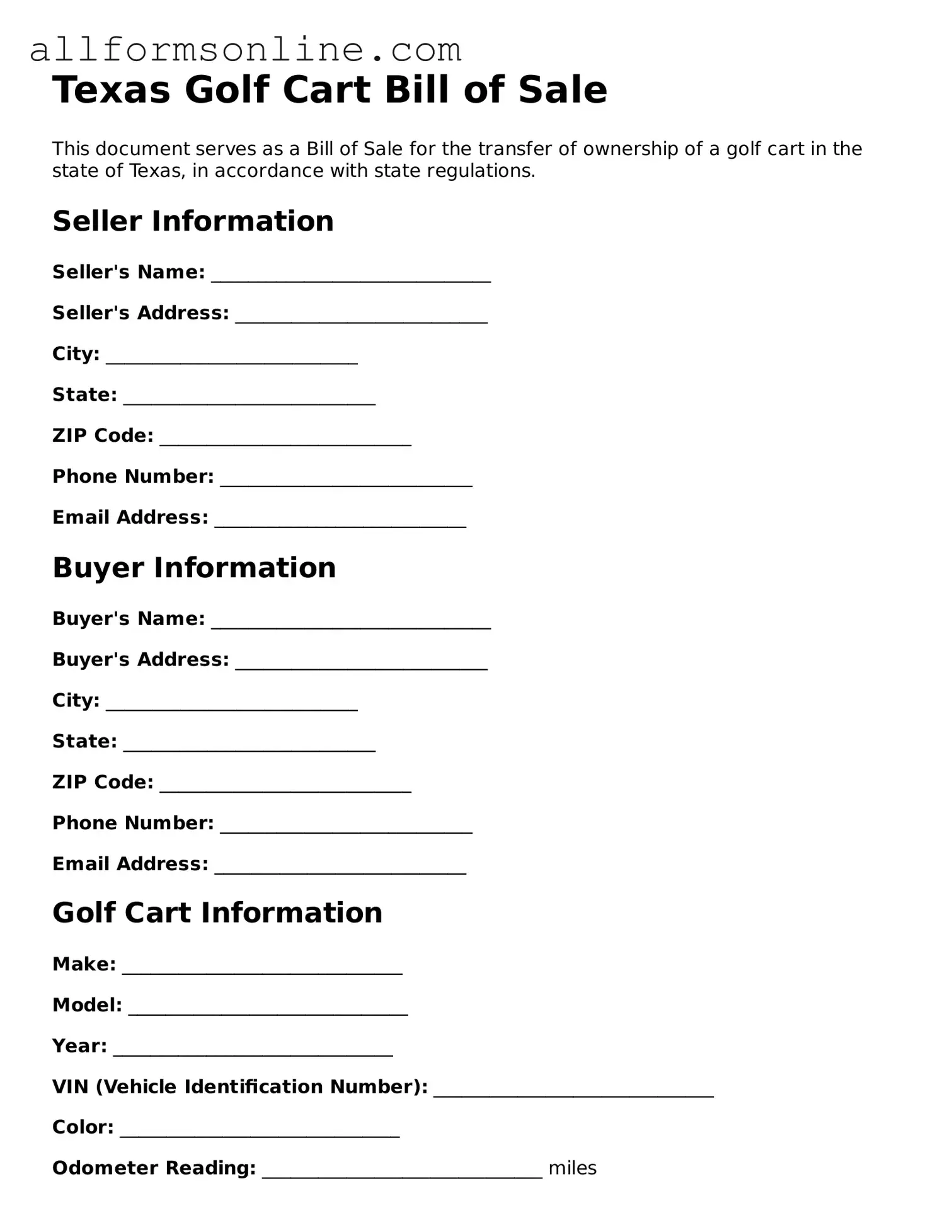

A Texas Golf Cart Bill of Sale is a legal document that records the sale of a golf cart between a seller and a buyer. This form includes important details such as the names and addresses of both parties, a description of the golf cart, the sale price, and the date of the transaction. It serves as proof of ownership and can be useful for registration purposes.

Is a Bill of Sale required to sell a golf cart in Texas?

While a Bill of Sale is not legally required in Texas for every sale, it is highly recommended. This document provides a clear record of the transaction and protects both the buyer and seller. It can help resolve disputes over ownership and can be necessary for registering the golf cart with the state.

What information should be included in the Bill of Sale?

A complete Bill of Sale should include the following information: the full names and addresses of the buyer and seller, a detailed description of the golf cart (including make, model, year, and Vehicle Identification Number), the sale price, and the date of the sale. Both parties should sign and date the document to make it valid.

Do I need to notarize the Bill of Sale?

Notarization is not required for a Texas Golf Cart Bill of Sale. However, having the document notarized can add an extra layer of security and authenticity. It can help verify the identities of both parties and may be beneficial if any disputes arise in the future.

Can I use a generic Bill of Sale form for my golf cart?

Yes, you can use a generic Bill of Sale form for your golf cart. However, it’s best to ensure that the form includes all necessary details specific to the sale of a golf cart. Using a specialized form designed for golf carts can help avoid missing important information and ensure compliance with any local regulations.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer may need to present this document when registering the golf cart with the Texas Department of Motor Vehicles. It’s also a good idea for the seller to keep a record of the transaction in case any questions arise later on.

Other Common State-specific Golf Cart Bill of Sale Forms

Golf Cart Bill of Sale Florida - It helps establish a timeline for the transfer of ownership.

In addition to the essential information provided, individuals looking to ensure they have a comprehensive understanding of the legalities involved should consider accessing templates such as the one available at Fast PDF Templates, which can aid in the creation of a precise and effective Release of Liability form.

How to Use Texas Golf Cart Bill of Sale

Completing the Texas Golf Cart Bill of Sale form is essential for transferring ownership of a golf cart. After filling out the form, both the buyer and seller should retain a copy for their records. This ensures that both parties have proof of the transaction.

- Obtain the Texas Golf Cart Bill of Sale form from a reliable source.

- Enter the date of the sale at the top of the form.

- Provide the full name and address of the seller in the designated section.

- Fill in the buyer's full name and address.

- Include the golf cart's make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price of the golf cart.

- Indicate the method of payment (cash, check, etc.).

- Both the seller and buyer should sign and date the form at the bottom.

- Make copies of the completed form for both parties.