Attorney-Approved Lady Bird Deed Form for Texas

Misconceptions

The Texas Lady Bird Deed is a useful estate planning tool, but several misconceptions surround it. Understanding these misconceptions can help individuals make informed decisions about their property and estate planning.

- Misconception 1: The Lady Bird Deed only benefits elderly individuals.

- Misconception 2: A Lady Bird Deed avoids probate entirely.

- Misconception 3: The grantor loses control of the property once the deed is executed.

- Misconception 4: The Lady Bird Deed eliminates tax implications.

- Misconception 5: All states recognize the Lady Bird Deed.

This is not true. While many people who use the Lady Bird Deed are older, it is suitable for anyone who wants to transfer property while retaining certain rights.

While the Lady Bird Deed can simplify the transfer process and may reduce the likelihood of probate, it does not guarantee that probate will be avoided in all situations.

This is incorrect. The grantor retains control and can sell, mortgage, or change the deed at any time during their lifetime.

While it can provide certain tax benefits, the property may still be subject to capital gains taxes or other tax implications upon sale or transfer.

This is false. The Lady Bird Deed is specific to Texas and may not be valid or recognized in other states.

What to Know About This Form

What is a Lady Bird Deed in Texas?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners in Texas to transfer their property to beneficiaries while retaining control during their lifetime. This type of deed enables the property owner to live in the home, sell it, or make changes without needing consent from the beneficiaries. Upon the owner's death, the property automatically transfers to the designated beneficiaries, bypassing the probate process.

What are the benefits of using a Lady Bird Deed?

There are several advantages to utilizing a Lady Bird Deed. First, it helps avoid probate, which can be time-consuming and costly. Second, the property owner retains the right to use and control the property during their lifetime. This means they can sell or mortgage the property without needing to consult the beneficiaries. Additionally, it may offer tax benefits, as the property can receive a stepped-up basis upon the owner's death, potentially reducing capital gains taxes for the beneficiaries.

Who can be named as beneficiaries in a Lady Bird Deed?

Beneficiaries can include anyone the property owner chooses, such as family members, friends, or even charities. The flexibility in naming beneficiaries allows property owners to tailor their estate plans according to their wishes. However, it is important to ensure that the chosen beneficiaries are aware of their designation and understand the implications of receiving the property.

How does a Lady Bird Deed differ from a traditional life estate deed?

The key difference lies in the level of control retained by the property owner. With a traditional life estate deed, the owner relinquishes some control over the property, as the beneficiaries often have rights to the property once the owner passes away. In contrast, a Lady Bird Deed allows the owner to maintain full control, providing greater flexibility and peace of mind during their lifetime.

Is it necessary to have an attorney to create a Lady Bird Deed?

While it is not legally required to hire an attorney to create a Lady Bird Deed, it is highly advisable. An attorney can ensure that the deed is drafted correctly, complies with Texas laws, and accurately reflects the property owner's intentions. Mistakes in the deed could lead to unintended consequences, making professional guidance a wise investment.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified by the property owner at any time during their lifetime. This flexibility allows property owners to adjust their estate plans as circumstances change, such as the addition of new beneficiaries or changes in personal relationships. To revoke or change the deed, the property owner must execute a new deed that explicitly states the revocation or modification.

Other Common State-specific Lady Bird Deed Forms

Lady Bird Deed Florida Form - The Lady Bird Deed represents a proactive step in managing family property dynamics.

Obtaining the Texas Certificate of Insurance is essential for all Responsible Master Plumbers, as it not only affirms their compliance with state regulations but also protects them from potential liabilities. It's important to ensure that your insurance coverage meets the necessary standards outlined by the Texas State Board of Plumbing Examiners. For a streamlined process, you can easily fill out your form online at texasformspdf.com/fillable-texas-certificate-insurance-online.

How to Use Texas Lady Bird Deed

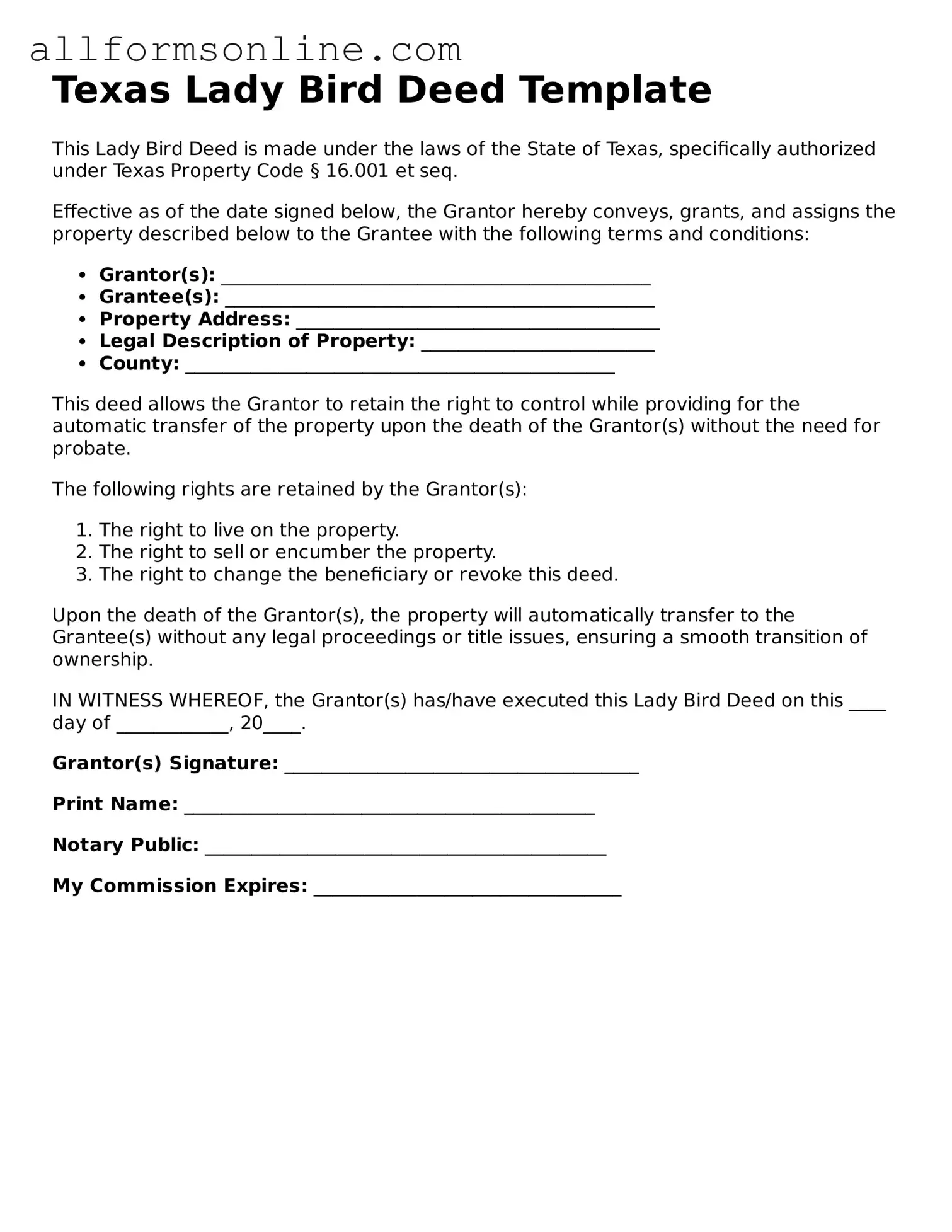

After obtaining the Texas Lady Bird Deed form, you can begin the process of filling it out. This deed allows you to transfer property while retaining certain rights. Follow these steps to ensure you complete the form accurately.

- Gather necessary information: Collect details about the property, including the legal description and address.

- Identify the grantor: Write your name as the person transferring the property.

- List the grantee: Enter the names of the individuals who will receive the property.

- Include the legal description: Provide the full legal description of the property. This may be found on your current deed or property tax records.

- Specify retained rights: Clearly state that you are retaining the right to live in the property and make changes as needed during your lifetime.

- Sign the form: As the grantor, sign and date the deed in the designated area.

- Have the form notarized: Take the signed form to a notary public to have it officially notarized.

- File the deed: Submit the notarized deed to the county clerk's office where the property is located.

Completing these steps will help ensure the Texas Lady Bird Deed is filled out correctly. Once filed, it will officially transfer the property according to your wishes.