Attorney-Approved Last Will and Testament Form for Texas

Misconceptions

When it comes to creating a Last Will and Testament in Texas, several misconceptions can lead to confusion. Understanding the facts can help ensure your wishes are honored. Here are eight common misconceptions:

- My will must be notarized to be valid. In Texas, a will does not need to be notarized to be valid. However, having a self-proving affidavit can simplify the probate process.

- Only wealthy people need a will. Everyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are followed after your passing.

- Once I write my will, I never need to change it. Life changes such as marriage, divorce, or the birth of a child may require updates to your will. Regular reviews are essential.

- My will can be verbal. In Texas, a will must be in writing to be valid. Oral wills are not recognized unless specific conditions are met.

- All my assets will go to my spouse automatically. While many assets may pass to a spouse, some may require a will to specify your wishes, especially if there are children from previous relationships.

- Having a will avoids probate. A will does not avoid probate. It simply provides instructions for the probate process to follow.

- Only a lawyer can create a valid will. While it is advisable to consult a lawyer, individuals can create a valid will on their own, provided it meets Texas legal requirements.

- My will can include instructions for my funeral. While you can express your wishes in your will, it may not be the best place for funeral instructions. Consider writing a separate document for that purpose.

Clearing up these misconceptions can help you make informed decisions about your estate planning. Take the time to ensure your wishes are clearly outlined and understood.

What to Know About This Form

What is a Last Will and Testament in Texas?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Texas, this document allows individuals to specify who will inherit their property, appoint guardians for minor children, and designate an executor to manage the estate. It serves to ensure that a person's wishes are followed and can help avoid disputes among family members.

Who can create a Last Will and Testament in Texas?

In Texas, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. It is essential that the individual understands the nature of their actions and the implications of the will. Minors and those deemed mentally incapacitated cannot create a valid will.

What are the requirements for a valid will in Texas?

To be valid in Texas, a will must be in writing and signed by the testator (the person making the will) or by someone else at the testator's request and in their presence. Additionally, the will must be witnessed by at least two individuals who are not beneficiaries of the will. These witnesses must sign the document in the presence of the testator.

Can I change my will after it has been created?

Yes, you can change your will at any time while you are alive and mentally competent. This can be done by creating a new will or by making a codicil, which is an amendment to the existing will. It is important to ensure that any changes comply with Texas law to maintain the validity of the will.

What happens if I die without a will in Texas?

If a person dies without a will, they are considered to have died "intestate." In this case, Texas law determines how the deceased's assets will be distributed. Generally, the estate will be divided among surviving relatives according to a specific hierarchy, which may not align with the deceased's wishes. This can lead to complications and disputes among family members.

How can I revoke my will in Texas?

A will can be revoked in several ways in Texas. The most common method is to create a new will that explicitly states that the previous will is revoked. Additionally, physically destroying the original will or making a formal written declaration of revocation can also serve to invalidate the previous document. It is advisable to inform your executor and witnesses about the revocation to avoid confusion.

Is it necessary to have an attorney to create a will in Texas?

While it is not legally required to have an attorney to create a will in Texas, it is highly recommended. An attorney can help ensure that the will is valid, meets all legal requirements, and accurately reflects your wishes. They can also provide guidance on complex issues, such as tax implications and the distribution of assets.

How can I ensure my will is executed properly after my death?

To ensure your will is executed properly, appoint a trustworthy executor who understands their responsibilities. Inform your executor and family members about the location of the will. Additionally, consider discussing your wishes with your loved ones to minimize confusion and potential conflicts. Keeping the will in a safe but accessible place is also crucial.

What should I include in my Last Will and Testament?

Your Last Will and Testament should include key elements such as the identification of beneficiaries, the distribution of your assets, the appointment of an executor, and guardianship provisions for minor children. You may also wish to include specific bequests, such as personal items or charitable donations. Clarity and detail can help avoid misunderstandings and ensure your wishes are honored.

Other Common State-specific Last Will and Testament Forms

Where to Make a Will - Documents who will handle one's funeral and burial arrangements.

What Are the Requirements for a Will to Be Valid in Florida - Facilitates communication about final wishes among family members.

The crucial Non-disclosure Agreement serves as an essential tool for businesses to safeguard proprietary information and maintain confidentiality during negotiations and collaborations.

Template for a Will - Can reflect cultural or religious traditions in the context of asset distribution.

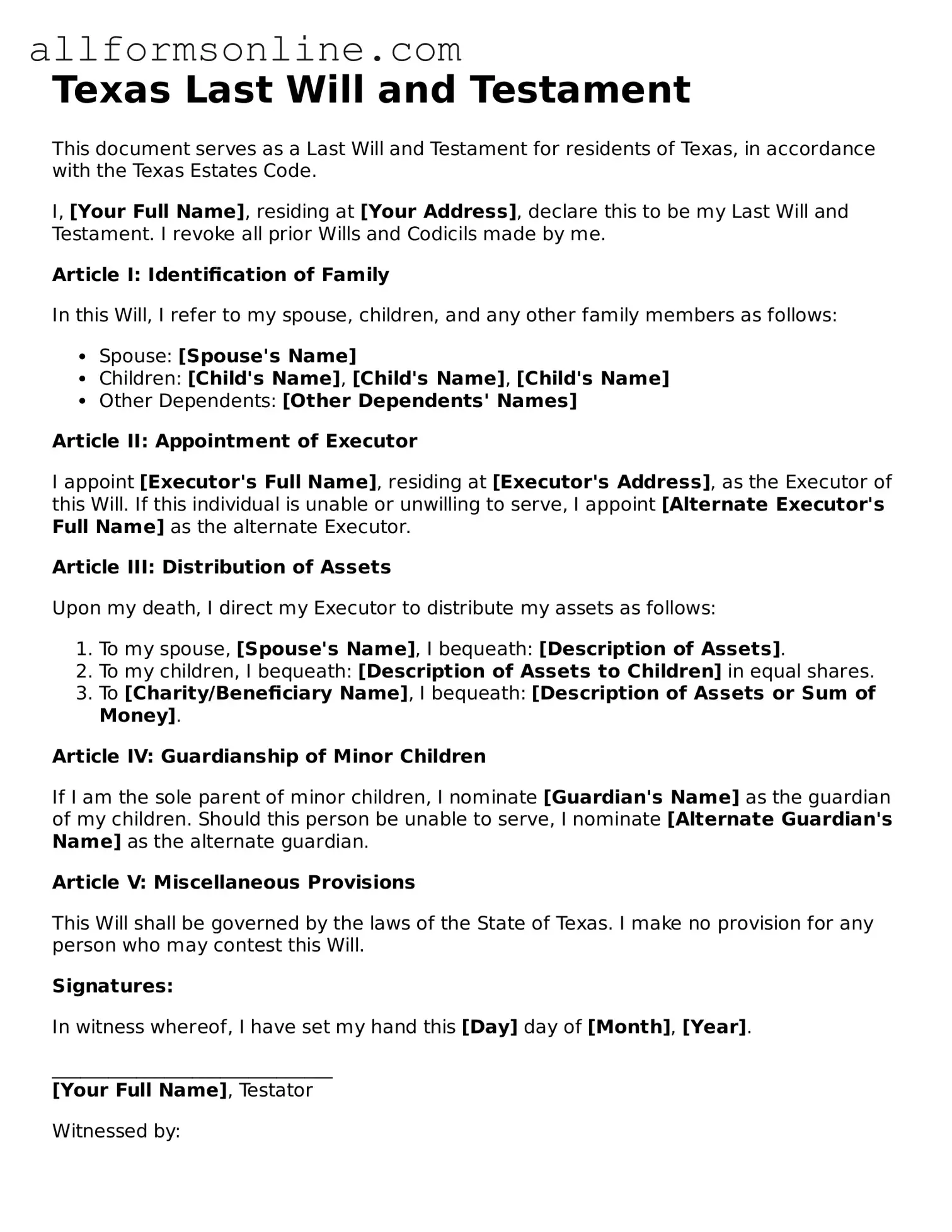

How to Use Texas Last Will and Testament

Completing a Texas Last Will and Testament form is an important step in ensuring that your wishes are honored after your passing. After filling out the form, it is crucial to review it carefully and ensure it is signed properly to make it legally binding.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- Clearly state that this document is your Last Will and Testament.

- Identify your beneficiaries by listing their full names and relationship to you.

- Designate an executor who will carry out the terms of your will. Include their full name and contact information.

- If applicable, specify any guardians for minor children, including their names and relationship to the children.

- Detail how you want your assets distributed among your beneficiaries. Be specific about items or amounts.

- Include any specific requests or instructions you wish to add.

- Sign and date the form at the designated area. Ensure that your signature is witnessed by at least two individuals who are not beneficiaries.

- Have the witnesses sign and date the document as well, including their addresses.

After completing the form, store it in a safe place and inform your executor where it can be found. Regularly review and update your will as necessary to reflect any changes in your circumstances or wishes.