Attorney-Approved Loan Agreement Form for Texas

Misconceptions

When it comes to the Texas Loan Agreement form, there are several misconceptions that can lead to confusion. Understanding these can help borrowers and lenders navigate the process more smoothly. Here are eight common misconceptions:

- All loan agreements are the same. Many people believe that all loan agreements follow a standard format. In reality, each agreement can vary significantly based on the lender's requirements and the specific terms of the loan.

- Signing a loan agreement is just a formality. Some borrowers think that signing the agreement is merely a formality. However, this document is a legally binding contract, and both parties must understand its terms fully.

- You can change the terms after signing. Many assume that they can modify the terms of the agreement after it has been signed. Changes typically require a formal amendment and the consent of both parties.

- Only the lender is responsible for understanding the agreement. It's a common belief that only the lender needs to understand the loan agreement. In fact, borrowers should also take the time to read and comprehend all terms before signing.

- Verbal agreements are enough. Some people think that a verbal agreement is sufficient. However, a written loan agreement is essential for protecting both parties and ensuring clarity.

- Late fees are optional. Many borrowers believe that late fees can be waived at the lender's discretion. In truth, if late fees are included in the agreement, they are enforceable unless otherwise negotiated.

- The loan agreement is only for the lender's protection. It's a misconception that the loan agreement only serves the lender's interests. The document also protects the borrower's rights and outlines their obligations.

- All loan agreements require notarization. Some think that notarization is necessary for all loan agreements. While it can be beneficial, not all agreements require a notary to be valid.

By clearing up these misconceptions, both borrowers and lenders can engage more effectively in the loan process and ensure that they are making informed decisions.

What to Know About This Form

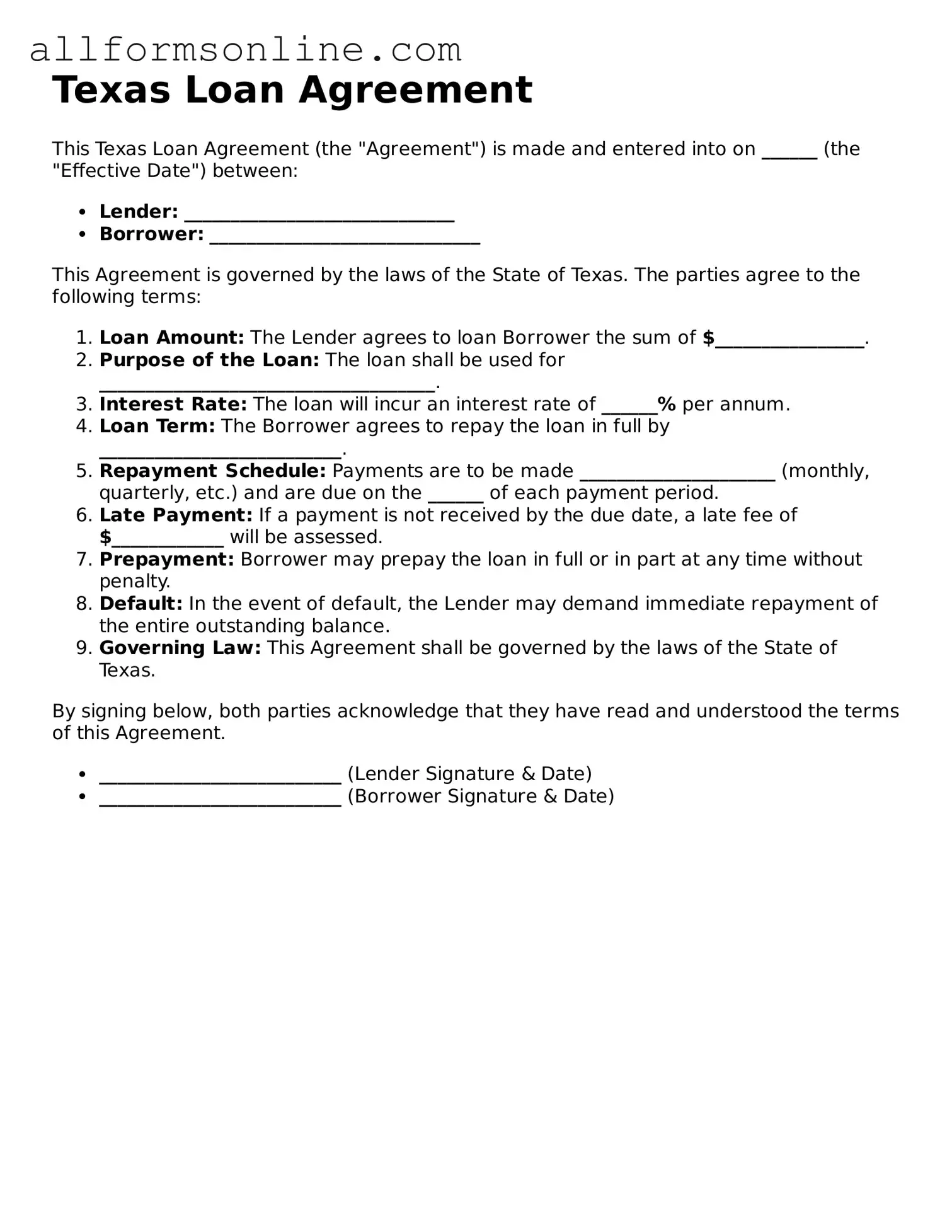

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount borrowed, interest rates, repayment schedules, and any collateral involved. This form helps protect the interests of both parties by clearly detailing their responsibilities and expectations.

Who typically uses a Texas Loan Agreement?

This form is commonly used by individuals and businesses in Texas seeking to formalize a loan arrangement. Whether it's a personal loan between friends or a business loan for operational expenses, having a written agreement ensures clarity and accountability for all parties involved.

What are the key components of a Texas Loan Agreement?

A typical Texas Loan Agreement includes several important elements. These typically consist of the loan amount, interest rate, repayment terms, due dates, and any fees associated with the loan. Additionally, it may outline the consequences of default, such as late fees or legal actions, and specify any collateral that secures the loan.

Is it necessary to have a Texas Loan Agreement notarized?

While notarization is not always required for a Texas Loan Agreement to be valid, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes in the future. It serves as proof that both parties willingly entered into the agreement.

Can a Texas Loan Agreement be modified after it is signed?

Yes, a Texas Loan Agreement can be modified, but both parties must agree to the changes. It’s essential to document any modifications in writing and have both parties sign the amended agreement. This helps maintain clarity and ensures that everyone is on the same page regarding the new terms.

What happens if the borrower defaults on the loan?

If a borrower defaults on the loan, the lender may have several options depending on the terms outlined in the agreement. These can include charging late fees, demanding immediate repayment, or pursuing legal action to recover the owed amount. The specifics will depend on the provisions included in the Loan Agreement.

Are there any state-specific laws that affect Texas Loan Agreements?

Yes, Texas has specific laws that govern loan agreements, including interest rate limits and disclosure requirements. It's important for both lenders and borrowers to be aware of these regulations to ensure compliance and avoid potential legal issues. Consulting with a legal expert can provide valuable insights into these laws.

Where can I obtain a Texas Loan Agreement form?

Texas Loan Agreement forms can be found through various online legal resources, law offices, or financial institutions. Many websites offer templates that can be customized to fit your needs. However, it’s wise to review the document carefully or seek legal advice to ensure it meets all necessary legal requirements.

Other Common State-specific Loan Agreement Forms

Promissory Note California - Outlines the lender's rights to monitor borrower’s financial status.

In order to facilitate a clear and successful vehicle transaction, it is advisable for both buyers and sellers to utilize resources such as the Fast PDF Templates, which provide comprehensive templates for creating a California Vehicle Purchase Agreement that meets all legal requirements.

Promissory Note Template New York - May detail the borrower's obligation to maintain insurance on collateral.

How to Use Texas Loan Agreement

Filling out the Texas Loan Agreement form requires careful attention to detail. Each section must be completed accurately to ensure that all parties understand their rights and responsibilities. Follow the steps below to fill out the form correctly.

- Begin with the title section. Clearly write "Texas Loan Agreement" at the top of the document.

- Next, fill in the date on which the agreement is being executed.

- Identify the parties involved. Write the full legal names of both the lender and the borrower. Include their addresses for clarity.

- Specify the loan amount. Clearly state the total sum being borrowed.

- Outline the interest rate. Indicate whether it is fixed or variable and provide the applicable percentage.

- Detail the repayment terms. Specify the duration of the loan and the schedule for payments (monthly, quarterly, etc.).

- Include any fees associated with the loan. This could cover late fees, origination fees, or any other charges.

- Describe any collateral involved, if applicable. Clearly identify what assets are being used to secure the loan.

- Ensure all parties sign and date the agreement. This includes the lender and the borrower, along with any witnesses if required.

- Make copies of the signed agreement for all parties involved to retain for their records.