Attorney-Approved Operating Agreement Form for Texas

Misconceptions

Understanding the Texas Operating Agreement form is crucial for anyone involved in a limited liability company (LLC) in Texas. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- Misconception 1: The Operating Agreement is mandatory for all LLCs in Texas.

- Misconception 2: The Operating Agreement must be filed with the state.

- Misconception 3: An Operating Agreement only addresses financial matters.

- Misconception 4: All members must agree on the Operating Agreement's terms.

- Misconception 5: The Operating Agreement cannot be changed once it is created.

While having an Operating Agreement is highly recommended, it is not legally required in Texas. However, without one, the default rules of the Texas LLC Act will govern the company, which may not align with the members' intentions.

The Operating Agreement is an internal document. It does not need to be filed with the Texas Secretary of State. Instead, it should be kept on record by the LLC and available for reference by its members.

While financial provisions are important, the Operating Agreement covers a wide range of topics. It outlines management structure, member responsibilities, and procedures for adding or removing members, among other things.

While it is best practice for all members to discuss and agree on the terms, the Operating Agreement can be created and adopted by a majority vote, depending on what the document specifies.

The Operating Agreement is a flexible document. Members can amend it as needed, provided they follow the amendment procedures outlined within the agreement itself.

What to Know About This Form

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC) in Texas. It serves as an internal guideline for the members, detailing how the business will be run, how profits and losses will be distributed, and how decisions will be made. While not required by state law, having an operating agreement is highly recommended to clarify the roles and responsibilities of each member and to help prevent disputes.

Why should I create an Operating Agreement for my LLC?

Creating an Operating Agreement is beneficial for several reasons. First, it helps establish clear expectations among members, reducing the likelihood of misunderstandings. Second, it can provide protection for your personal assets by reinforcing the limited liability status of the LLC. Third, having this document in place can make it easier to manage the business, especially when it comes to making major decisions or handling member changes. Overall, it helps ensure that everyone is on the same page.

What key elements should be included in a Texas Operating Agreement?

When drafting a Texas Operating Agreement, consider including the following key elements: the name and purpose of the LLC, the names and contributions of the members, how profits and losses will be allocated, the management structure (whether member-managed or manager-managed), and procedures for adding or removing members. You might also want to outline how disputes will be resolved and how the agreement can be amended in the future.

Is it necessary to file the Operating Agreement with the state?

No, you do not need to file your Operating Agreement with the state of Texas. This document is kept internally among the members of the LLC. However, it is important to have it in writing and accessible, as it can be referenced in the event of disputes or legal issues. Keeping it organized and up to date is essential for smooth operations.

Can I change my Operating Agreement after it has been created?

Yes, you can change your Operating Agreement at any time, provided that all members agree to the amendments. It’s important to document any changes in writing and to have all members sign off on the updated agreement. This ensures that everyone is aware of the modifications and helps maintain clarity in your LLC's operations.

Other Common State-specific Operating Agreement Forms

Pennsylvania Llc Operating Agreement - It helps ensure that the LLC operates smoothly without confusion.

Completing an Employment Application PDF form correctly is crucial for candidates looking to impress potential employers. Alongside personal information and work history, highlighting relevant skills can set one apart in a competitive job market. Resources like Fast PDF Templates provide valuable templates to ensure that applicants present their qualifications effectively and professionally.

How to Get Llc - The agreement is a critical tool for facilitating business continuity.

Does Llc Need Operating Agreement - It can help establish a sense of trust and security among the LLC members.

How to Use Texas Operating Agreement

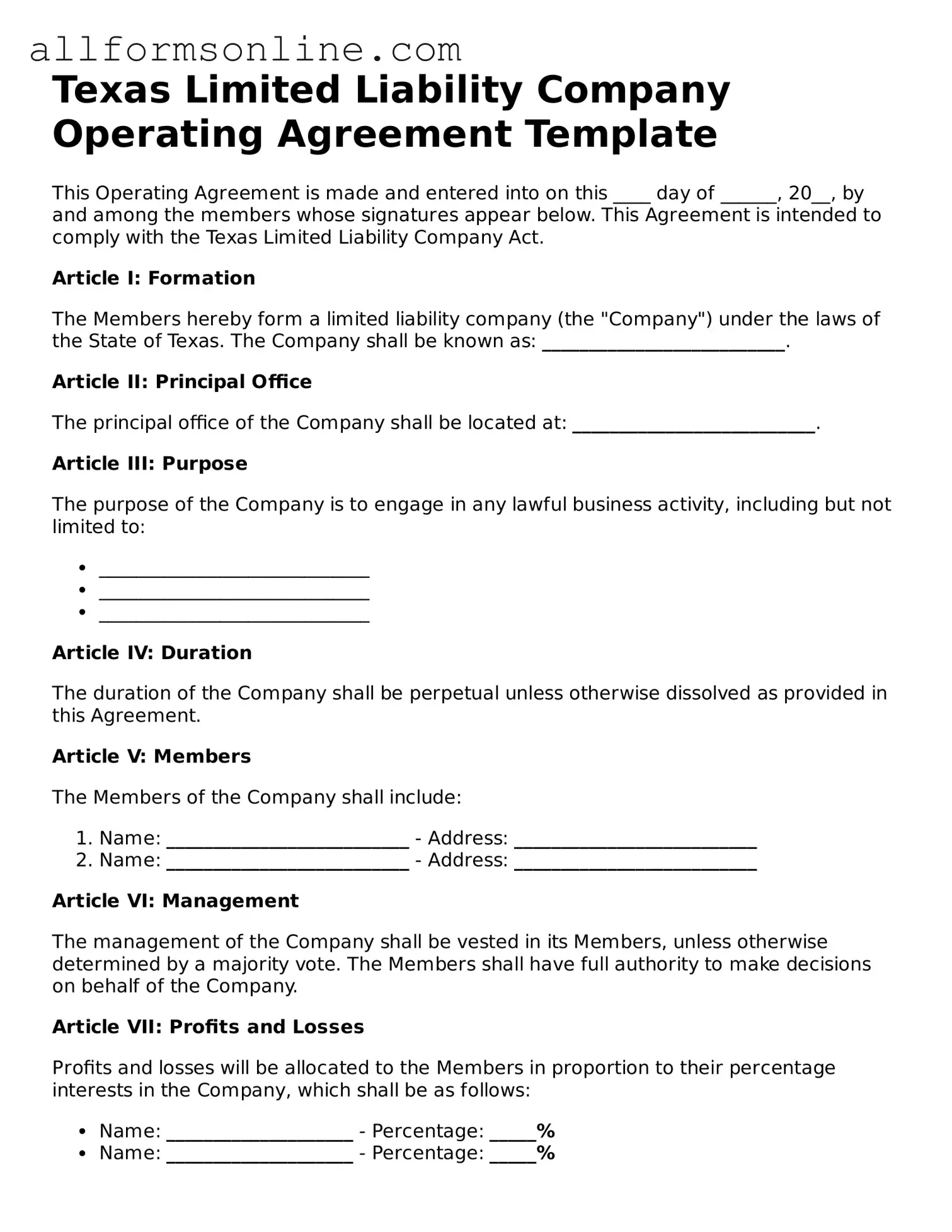

After obtaining the Texas Operating Agreement form, you are ready to fill it out. This document is essential for outlining the management structure and operational procedures of your business. Follow the steps below to complete the form accurately.

- Begin by entering the name of your limited liability company (LLC) at the top of the form. Ensure that the name matches the one registered with the state.

- Provide the principal office address of the LLC. This should be a physical address where the business operates, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. This includes anyone who has an ownership interest in the company.

- Specify the management structure of the LLC. Indicate whether the business will be managed by its members or by appointed managers.

- Detail the voting rights of each member. This section should clarify how decisions will be made and the weight of each member's vote.

- Outline the profit and loss distribution among members. Clearly state how profits will be shared and any specific percentages that apply.

- Include provisions for adding or removing members. This should cover the process and any requirements that must be met.

- Address the dissolution of the LLC. Specify the circumstances under which the business may be dissolved and the steps to be taken.

- Review the entire document for accuracy. Ensure that all information is correct and that there are no omissions.

- Finally, have all members sign and date the agreement. This step is crucial, as it indicates that everyone agrees to the terms outlined in the document.