Attorney-Approved Power of Attorney Form for Texas

Misconceptions

Understanding the Texas Power of Attorney form is crucial for effective legal planning. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- It is only for elderly individuals. Many believe that a Power of Attorney is only necessary for seniors. In reality, anyone can benefit from having this document, especially those facing health issues or undergoing significant life changes.

- It automatically goes into effect. Some think that a Power of Attorney becomes active immediately upon signing. However, it can be set to activate only under specific conditions, such as when the principal becomes incapacitated.

- All Powers of Attorney are the same. There are different types of Powers of Attorney, including durable, medical, and financial. Each serves a distinct purpose and has different implications.

- It can be used indefinitely. Many assume that a Power of Attorney remains valid forever. In fact, it can be revoked or terminated under certain circumstances, such as the principal's death or explicit revocation.

- Only lawyers can create a Power of Attorney. While legal assistance can be beneficial, individuals can draft their own Power of Attorney using templates, as long as they comply with Texas law.

- It gives unlimited power to the agent. Some believe that the agent can do anything they want. In reality, the principal can specify the powers granted and set limits on the agent's authority.

- It is not necessary if you have a will. A will only takes effect after death, whereas a Power of Attorney is essential for making decisions on behalf of someone who is alive but unable to act for themselves.

Addressing these misconceptions is vital for ensuring that individuals make informed decisions regarding their legal and financial affairs.

What to Know About This Form

What is a Power of Attorney in Texas?

A Power of Attorney (POA) in Texas is a legal document that allows one person, known as the principal, to authorize another person, called the agent or attorney-in-fact, to make decisions on their behalf. This can include financial decisions, health care choices, or any other matters specified in the document. It's a powerful tool for managing your affairs, especially if you become unable to do so yourself.

Why would someone need a Power of Attorney?

There are many reasons why someone might need a Power of Attorney. Perhaps you’re planning for the future and want to ensure that someone you trust can handle your affairs if you become incapacitated. Or maybe you’re traveling abroad and need someone to manage your finances while you’re away. A POA can provide peace of mind, knowing that your interests are protected even when you’re not able to manage them yourself.

What types of Power of Attorney are available in Texas?

In Texas, there are several types of Power of Attorney. The most common are Durable Power of Attorney, which remains effective even if the principal becomes incapacitated, and Medical Power of Attorney, which specifically allows the agent to make health care decisions. There are also limited or specific POAs that grant authority only for particular tasks, such as selling a property or handling a bank account.

How do I create a Power of Attorney in Texas?

Creating a Power of Attorney in Texas involves a few simple steps. First, you need to choose a trusted individual to act as your agent. Then, you can either use a template or consult with an attorney to draft the document. It must be signed by you and, in most cases, witnessed by two individuals or notarized to ensure its validity. Once completed, keep the original in a safe place and provide copies to your agent and any relevant institutions.

Can I revoke a Power of Attorney in Texas?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that had the original POA. It’s important to ensure that everyone involved is aware of the revocation to prevent any confusion in the future.

What happens if I don’t have a Power of Attorney?

If you don’t have a Power of Attorney and become incapacitated, your loved ones may have to go through a lengthy court process to obtain guardianship. This can be stressful and costly for your family. Without a POA, you lose the ability to choose who will manage your affairs, which is why having one in place is so important.

Can a Power of Attorney be used for financial decisions?

Absolutely! A Power of Attorney can grant your agent the authority to make financial decisions on your behalf. This can include managing bank accounts, paying bills, filing taxes, and even selling property. You can specify the extent of these powers in the document, so you have control over what your agent can and cannot do.

Is a Power of Attorney valid if I move to another state?

A Power of Attorney created in Texas is generally valid in other states, but it’s wise to check the specific laws of the state you are moving to. Some states may have different requirements or may require a new POA to be executed. If you are relocating, consider consulting with a local attorney to ensure your documents remain valid and effective.

What should I consider when choosing an agent for my Power of Attorney?

Choosing an agent for your Power of Attorney is a significant decision. Look for someone you trust completely, as they will have the authority to make important decisions on your behalf. Consider their ability to handle financial matters, their willingness to act in your best interests, and their availability to take on this responsibility. Open communication about your wishes and expectations is also crucial to ensure they understand your preferences.

Other Common State-specific Power of Attorney Forms

Power of Attorney Sacramento - The form can be created for both short-term and long-term authority needs.

When preparing to submit an application for a position, it's essential to utilize comprehensive resources such as the Fast PDF Templates, which offer various templates and guidance on filling out an Employment Application PDF form accurately. This approach can help ensure that all necessary information, including personal details and qualifications, is presented clearly and professionally, ultimately increasing the likelihood of a successful application.

Pa Power of Attorney Form - It is essential to choose a trustworthy individual as your agent in this document.

Nys Power of Attorney - Can create a shared responsibility between multiple agents.

Power of Attorney in Florida - In many cases, family members are encouraged to participate in discussions around establishing the Power of Attorney.

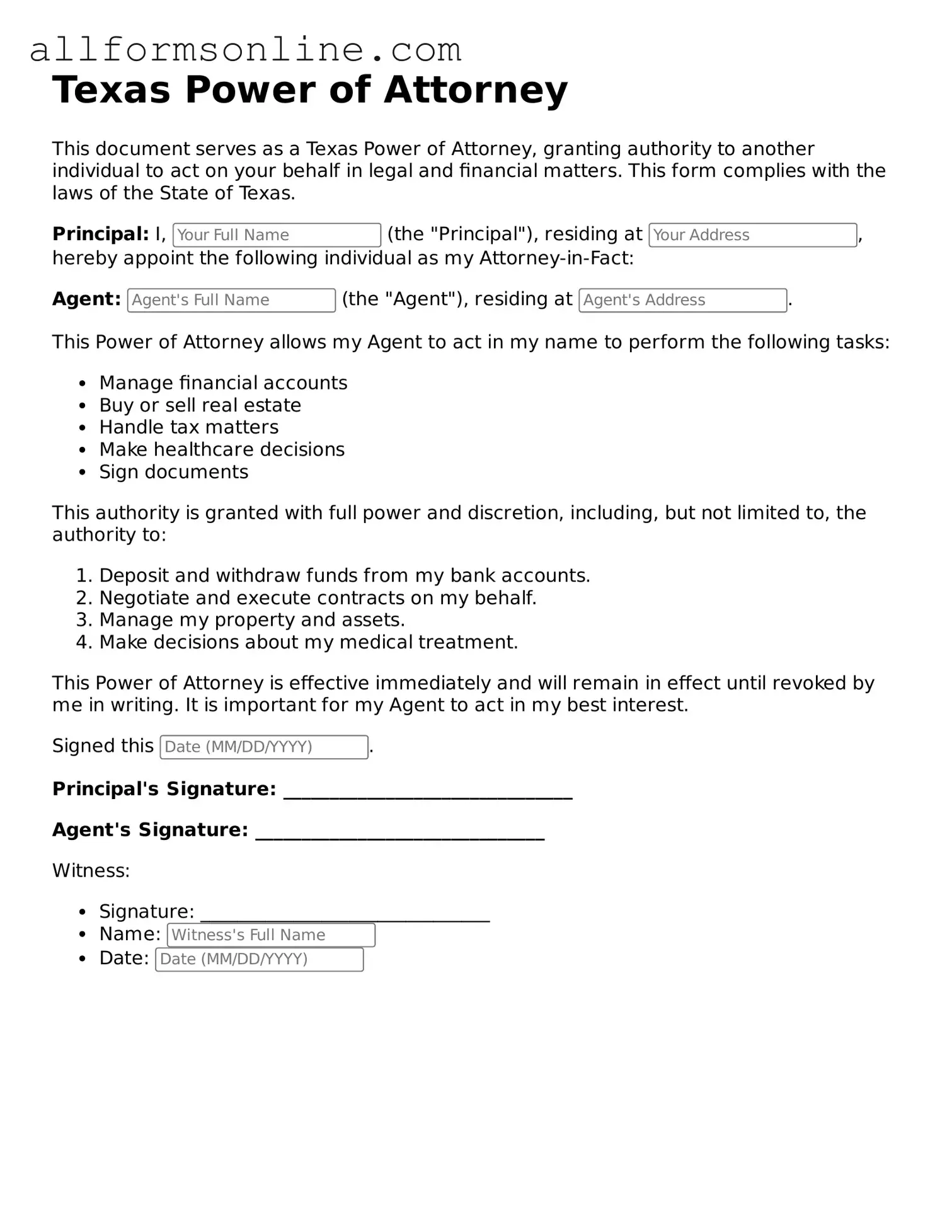

How to Use Texas Power of Attorney

Once you have obtained the Texas Power of Attorney form, you will need to complete it carefully to ensure that it is valid and reflects your intentions. Follow these steps to fill out the form accurately.

- Begin by entering the date at the top of the form.

- Provide your full name and address in the designated section.

- Clearly identify the person you are appointing as your agent by including their full name and address.

- Specify the powers you wish to grant your agent. This may include financial decisions, health care decisions, or other specific tasks.

- Indicate any limitations on the powers granted, if applicable.

- Sign and date the form in the appropriate section. Ensure that your signature matches the name you provided at the beginning.

- Have the form notarized, if required. This step may vary based on your specific needs or the requirements of the institution receiving the document.

- Provide copies of the completed form to your agent and any relevant parties.