Attorney-Approved Promissory Note Form for Texas

Misconceptions

Understanding the Texas Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- It must be notarized to be valid. Many people believe that a Texas Promissory Note must be notarized to be legally binding. In reality, notarization is not required for the note to be enforceable.

- Only formal lenders can use it. Some think that only banks or formal lending institutions can utilize a Promissory Note. However, individuals can also create and use this document for personal loans.

- All Promissory Notes are the same. Many assume that a Promissory Note is a one-size-fits-all document. In fact, terms can vary significantly based on the agreement between the parties involved.

- It doesn't need to specify repayment terms. Some people believe that a Promissory Note can be vague about repayment. In truth, clear repayment terms are crucial for the note's enforceability.

- Verbal agreements are sufficient. There is a misconception that a verbal agreement is enough to create a binding loan. A written Promissory Note provides clarity and legal protection for both parties.

- It can be changed at any time. Lastly, many think they can alter the terms of a Promissory Note whenever they wish. Changes usually require mutual consent and should be documented in writing.

Clearing up these misconceptions can help ensure that both lenders and borrowers understand their rights and obligations under Texas law.

What to Know About This Form

What is a Texas Promissory Note?

A Texas Promissory Note is a written agreement in which one party promises to pay a specified sum of money to another party at a designated time or on demand. This document outlines the terms of the loan, including the principal amount, interest rate, payment schedule, and any applicable fees. It serves as a legal record of the debt and can be enforced in a court of law if necessary.

Who typically uses a Texas Promissory Note?

Individuals and businesses commonly use Texas Promissory Notes in various situations. Lenders may use them when providing personal loans, business loans, or real estate financing. Borrowers, on the other hand, may need them when seeking funds for personal expenses, home purchases, or business ventures. This document is beneficial for both parties as it clarifies the terms of the loan and protects their interests.

What are the key components of a Texas Promissory Note?

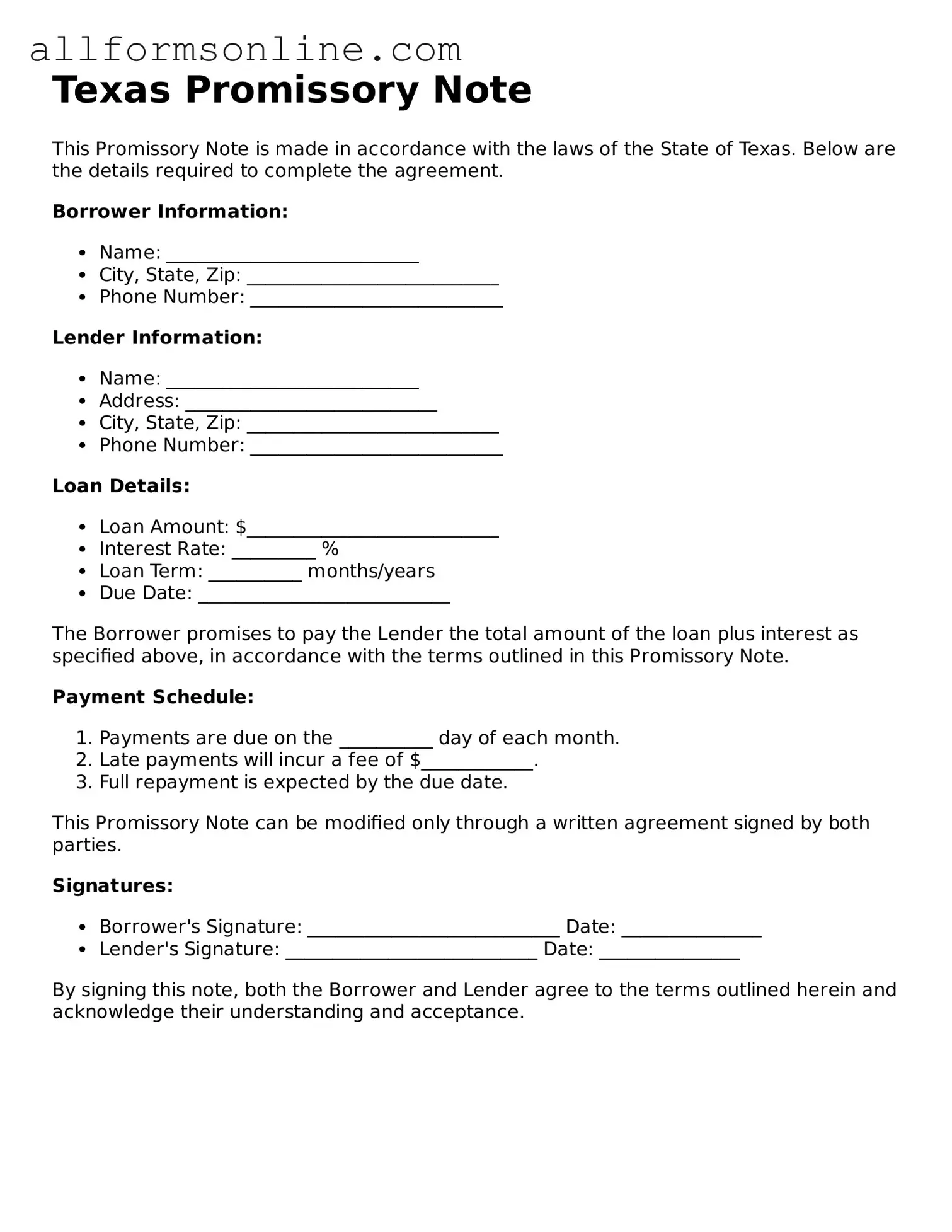

A Texas Promissory Note typically includes several important components. These components include the names and addresses of the borrower and lender, the principal amount borrowed, the interest rate, the payment schedule, and the maturity date. It may also specify any late fees or prepayment penalties. Including clear and concise terms helps prevent misunderstandings between the parties involved.

Is a Texas Promissory Note legally binding?

Yes, a Texas Promissory Note is legally binding once it is signed by both the borrower and the lender. This means that both parties are obligated to adhere to the terms outlined in the document. If the borrower fails to make payments as agreed, the lender has the right to take legal action to recover the owed amount. It is crucial for both parties to fully understand the terms before signing.

Do I need a lawyer to create a Texas Promissory Note?

While it is not legally required to have a lawyer draft a Texas Promissory Note, consulting with one can be beneficial. A lawyer can help ensure that the document complies with Texas laws and adequately protects your interests. However, many individuals choose to use standardized templates or forms available online, which can be effective if completed accurately and thoroughly.

Other Common State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - Terms of repayment can offer flexibility, catering to the borrower's financial situation.

How to Write a Promissory Note Example - This document helps establish a clear record of debt for both parties.

For anyone looking to successfully navigate vehicle transactions in the state, understanding the essential aspects of a Motor Vehicle Bill of Sale form is crucial. This valuable document streamlines the transfer process and can be accessed through the comprehensive Motor Vehicle Bill of Sale guidelines available online.

New York Promissory Note - A Promissory Note can serve as a tool for friends to formalize a loan safely.

How to Use Texas Promissory Note

After obtaining the Texas Promissory Note form, it’s essential to fill it out accurately to ensure clarity in the agreement. Follow these steps carefully to complete the form.

- Title the Document: Write "Promissory Note" at the top of the form.

- Insert Date: Write the date on which the note is being created.

- Borrower Information: Fill in the full name and address of the borrower.

- Lender Information: Provide the full name and address of the lender.

- Loan Amount: Clearly state the total amount being borrowed.

- Interest Rate: Indicate the interest rate applicable to the loan.

- Payment Terms: Specify the repayment schedule, including the frequency of payments and the due date for the final payment.

- Late Fees: Detail any fees that will apply if payments are late.

- Signatures: Ensure both the borrower and lender sign and date the document.

Once the form is completed, review it for accuracy. Both parties should retain a copy for their records. It’s advisable to consult with a legal professional to ensure all necessary provisions are included and to address any specific concerns related to the agreement.