Attorney-Approved Quitclaim Deed Form for Texas

Misconceptions

Understanding the Texas Quitclaim Deed can be challenging due to some common misconceptions. Here are five of them, clarified for better understanding:

-

A Quitclaim Deed Transfers Ownership Completely.

Many people believe that a quitclaim deed guarantees full ownership of the property. However, this type of deed only transfers whatever interest the grantor has at the time of the transfer. If the grantor has no ownership interest, the recipient receives nothing.

-

A Quitclaim Deed Provides Title Insurance.

This deed does not offer any warranties or guarantees regarding the title. Unlike warranty deeds, quitclaim deeds do not protect the buyer from any claims against the property. Therefore, it's wise to obtain title insurance separately to safeguard against potential issues.

-

Quitclaim Deeds are Only for Family Transfers.

While it’s true that quitclaim deeds are often used among family members, they can be used in various situations. They are also useful in divorce settlements, transferring property to a trust, or when clearing up title issues.

-

Using a Quitclaim Deed is Complicated.

Many people think that the process of using a quitclaim deed is overly complex. In reality, it is a straightforward document. As long as it is filled out correctly and filed with the county clerk, it can be a simple way to transfer property interests.

-

Quitclaim Deeds are Irrevocable.

Some believe that once a quitclaim deed is executed, it cannot be undone. However, if both parties agree, it is possible to revoke or modify the deed. This usually requires a new legal document to clarify the changes.

By understanding these misconceptions, individuals can make more informed decisions when dealing with property transfers in Texas.

What to Know About This Form

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike a warranty deed, it does not guarantee that the property is free of liens or other claims. This type of deed is often used between family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed in Texas?

You might consider using a Quitclaim Deed in various scenarios, such as transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or clarifying ownership in a joint ownership situation. It’s a straightforward way to handle property transfers without the complexities of a warranty deed.

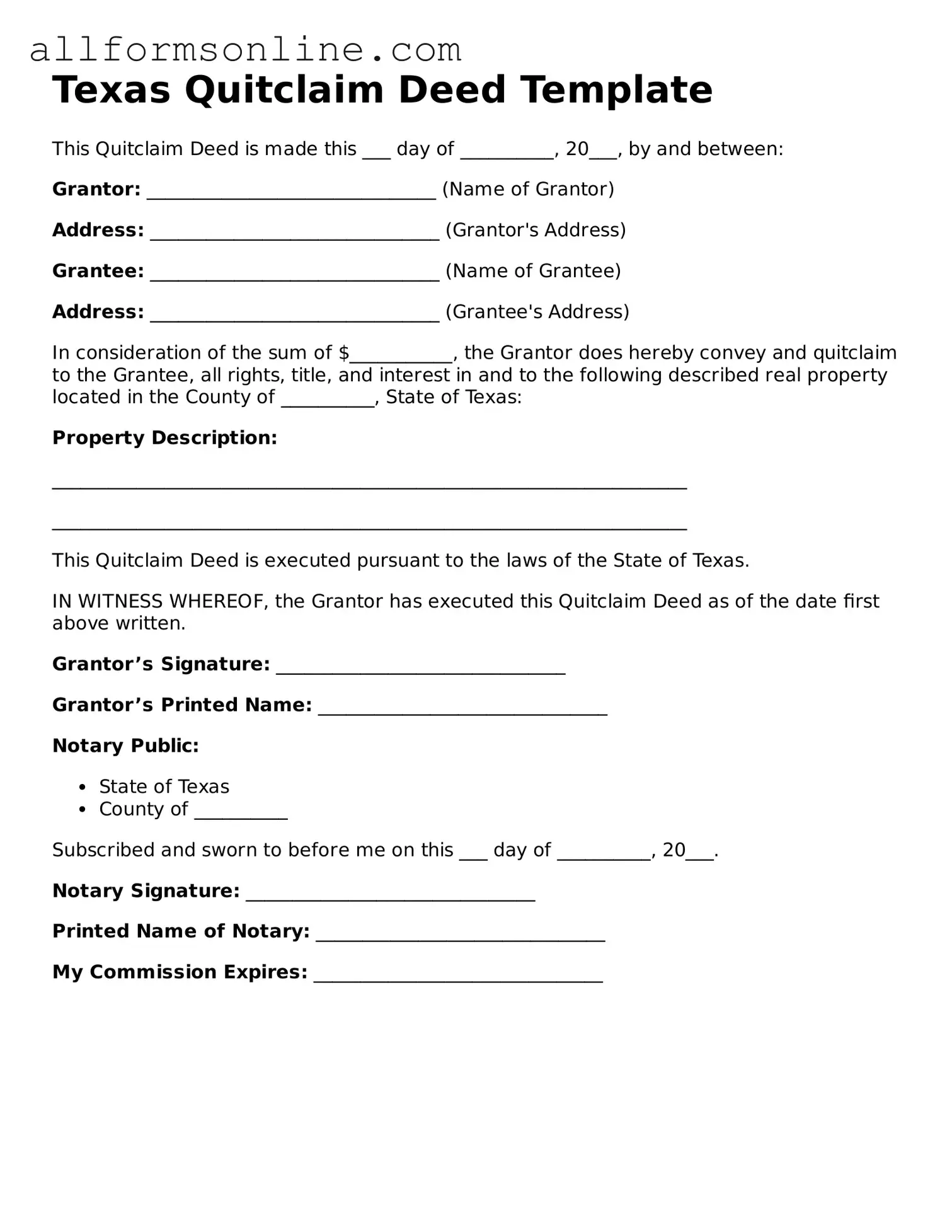

What information is required to complete a Quitclaim Deed?

To complete a Quitclaim Deed, you will need the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a legal description of the property, and the date of the transfer. It’s also important to include any relevant information regarding the consideration, or what is being exchanged for the property, even if it’s just a nominal amount.

Do I need to notarize a Quitclaim Deed in Texas?

Yes, a Quitclaim Deed must be signed in the presence of a notary public in Texas. The notary will verify the identities of the parties involved and witness the signing. This step is crucial for the deed to be legally binding and to ensure that it can be recorded with the county clerk’s office.

How do I record a Quitclaim Deed in Texas?

After completing and notarizing the Quitclaim Deed, you must file it with the county clerk’s office in the county where the property is located. There may be a recording fee, so check with the local office for the exact amount. Recording the deed officially updates public records and provides legal notice of the transfer.

Can a Quitclaim Deed be contested?

Yes, a Quitclaim Deed can be contested, but it can be more challenging than contesting other types of deeds. If there is evidence of fraud, coercion, or lack of capacity at the time of signing, a party may have grounds to contest the deed. Legal advice is often necessary in these situations to navigate the complexities involved.

Are there any tax implications when using a Quitclaim Deed?

There may be tax implications associated with transferring property via a Quitclaim Deed. While the transfer itself may not trigger a tax event, it’s essential to consult a tax professional to understand any potential capital gains taxes or property tax reassessments that could arise from the transaction.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed transfers whatever interest the grantor has in the property, without any warranties or guarantees regarding the title. This distinction is crucial when deciding which type of deed to use.

Other Common State-specific Quitclaim Deed Forms

Quit Claim Deed Form Ny - A Quitclaim Deed conveys what interest the grantor has, if any.

Quit Claim Deed Form Free - This deed can be used to clarify ownership in cases of joint tenancy.

Quick Deed Florida - Unlike warranty deeds, a Quitclaim Deed has no promises about the property title.

To ensure that your child's interests are protected when you are away, you may consider utilizing the comprehensive Power of Attorney for a Child legal document to authorize another adult to make necessary decisions on your child's behalf. For more information, visit the form available here.

Pennsylvania Quit Claim Deed Form - This type of deed can be advantageous for swift transactions without monetary exchange.

How to Use Texas Quitclaim Deed

After obtaining the Texas Quitclaim Deed form, you will need to fill it out accurately to ensure the transfer of property rights is legally recognized. Once completed, the form should be signed, notarized, and then filed with the county clerk's office where the property is located.

- Begin by entering the date at the top of the form.

- Identify the grantor (the person transferring the property). Provide their full name and address.

- Next, identify the grantee (the person receiving the property). Include their full name and address.

- Clearly describe the property being transferred. Include the legal description, which can often be found on the property’s current deed or tax documents.

- State any considerations for the transfer. This may include a dollar amount or simply state "for love and affection" if it is a gift.

- Sign the form in the presence of a notary public. The grantor must sign it, and the notary will complete their section.

- Make copies of the completed and signed deed for your records.

- Finally, file the original quitclaim deed with the county clerk’s office where the property is located. Pay any required filing fees.