Attorney-Approved Real Estate Purchase Agreement Form for Texas

Misconceptions

Misconceptions about the Texas Real Estate Purchase Agreement can lead to confusion for buyers and sellers alike. Here are seven common misunderstandings:

- The form is only for residential transactions. Many believe the Texas Real Estate Purchase Agreement is exclusive to residential real estate. In reality, it can also be used for commercial properties, although specific provisions may differ.

- All terms are negotiable. While many terms can be negotiated, some aspects of the agreement are standard and non-negotiable. Understanding which terms are flexible is crucial for effective negotiation.

- It protects the buyer's interests only. This form is designed to protect both parties involved in the transaction. It outlines the rights and obligations of both the buyer and the seller, ensuring fairness in the process.

- Once signed, it cannot be changed. Many think that once the agreement is signed, it is set in stone. Amendments can be made, but both parties must agree to any changes and document them properly.

- It guarantees financing. The agreement does not guarantee that a buyer will secure financing. Buyers must still obtain financing through their lender, and the agreement should include contingencies related to financing.

- It includes all necessary disclosures. Some assume that the purchase agreement covers all disclosures required by law. However, additional disclosures may be necessary, and it is important to ensure compliance with all relevant regulations.

- Using a standard form is sufficient. Relying solely on a standard form can lead to oversights. Each transaction is unique, and it is advisable to customize the agreement to reflect the specific circumstances of the deal.

What to Know About This Form

What is a Texas Real Estate Purchase Agreement?

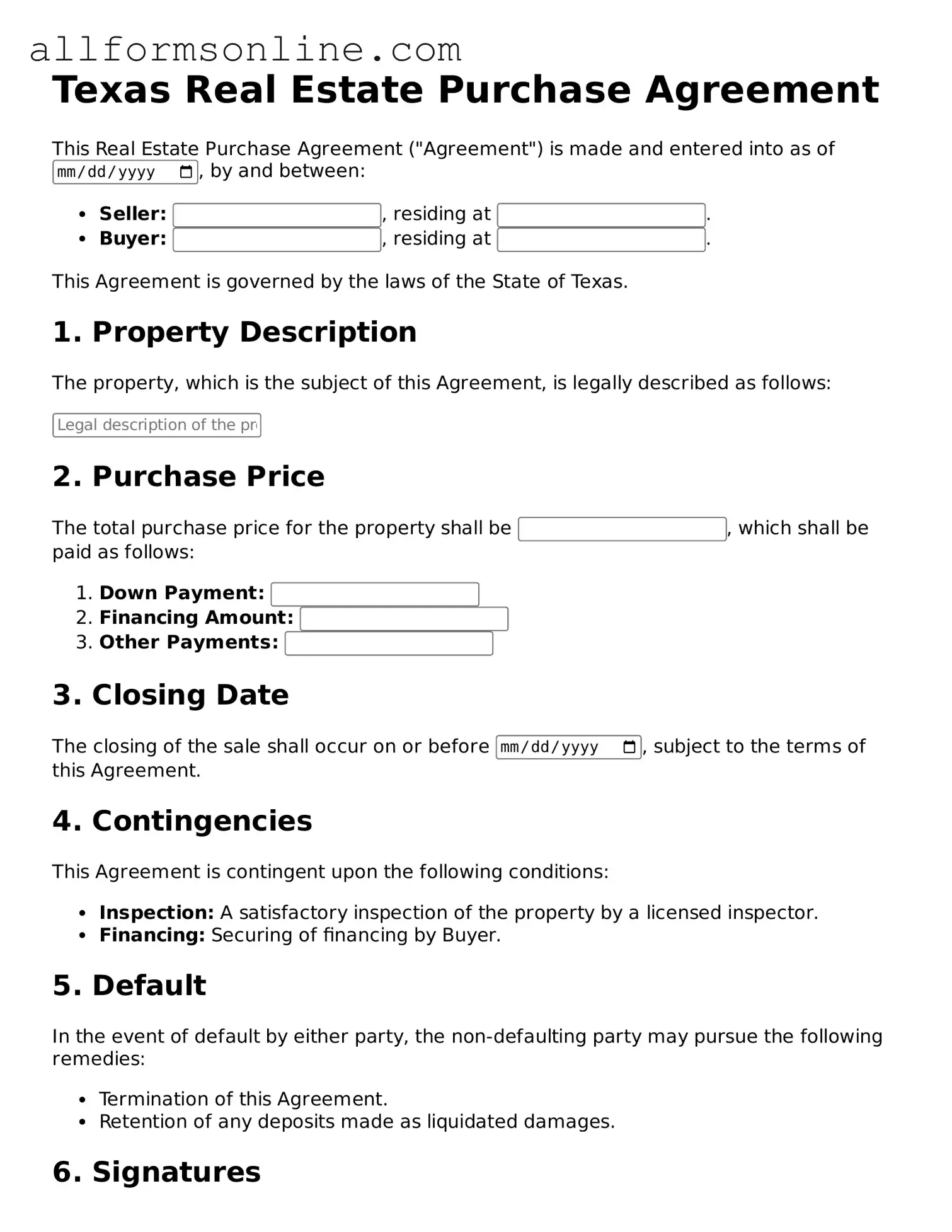

The Texas Real Estate Purchase Agreement is a legally binding document used when buying or selling real estate in Texas. It outlines the terms and conditions of the sale, including the purchase price, financing details, and any contingencies that must be met before the sale is finalized.

Who needs to use this agreement?

This agreement is essential for anyone involved in a real estate transaction in Texas. Whether you are a buyer or a seller, having a clear and comprehensive agreement helps protect your interests and ensures that all parties understand their rights and obligations.

What key elements are included in the agreement?

The agreement typically includes the property description, purchase price, earnest money amount, closing date, and any contingencies, such as inspections or financing. Additionally, it outlines the responsibilities of both the buyer and seller throughout the transaction process.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes. This is usually done through an addendum, which is a document that outlines the specific modifications. Always ensure that any changes are documented in writing to avoid misunderstandings later.

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations under the agreement, the other party may have legal recourse. This could include seeking damages or enforcing the terms of the agreement through the courts. It’s important to know your rights and options if this situation arises.

Is it necessary to have a lawyer review the agreement?

While it’s not legally required to have a lawyer review the Texas Real Estate Purchase Agreement, it is highly recommended. A legal professional can help ensure that your interests are protected and that the agreement complies with Texas laws.

What is earnest money, and why is it important?

Earnest money is a deposit made by the buyer to show their commitment to purchasing the property. It demonstrates good faith and can help secure the agreement. If the sale goes through, this money is typically applied to the purchase price. If the deal falls through due to a contingency, the buyer usually gets their earnest money back.

How long is the agreement valid?

The validity of the agreement depends on the terms set within it. Typically, the agreement will specify a closing date, which is when the sale is expected to be completed. If the closing does not occur by that date, the agreement may become void unless both parties agree to extend it.

What should I do if I have more questions about the agreement?

If you have further questions or concerns about the Texas Real Estate Purchase Agreement, consider reaching out to a real estate professional or a lawyer. They can provide personalized guidance based on your specific situation and help ensure that you make informed decisions throughout the process.

Other Common State-specific Real Estate Purchase Agreement Forms

Real Estate Purchase and Sale Agreement - The document helps ensure compliance with various federal and state regulations affecting real estate transactions.

Pennsylvania Real Estate Contract - The agreement may provide for an appraisal and how to handle differences in value.

Creating a reliable estate plan is crucial, and a well-drafted Last Will and Testament form serves as a key component in this process, ensuring that your final wishes are respected and your beneficiaries are clearly outlined.

Real Estate Sales Contract Form - The form often addresses any potential property easements or restrictions.

How to Use Texas Real Estate Purchase Agreement

Once you have the Texas Real Estate Purchase Agreement form in front of you, it's time to fill it out accurately. This document requires specific details about the property and the parties involved. Follow these steps carefully to ensure all necessary information is provided.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the buyer and the seller.

- Provide the legal description of the property. This can usually be found in the property deed.

- State the purchase price clearly. Include any earnest money deposit amount.

- Specify any financing details, including loan type and lender information, if applicable.

- Indicate the closing date or timeframe for the transaction.

- List any contingencies, such as inspections or financing approvals.

- Include any additional terms or conditions that may apply to the sale.

- Sign and date the agreement at the bottom, ensuring both parties do the same.

After completing the form, review it for accuracy. Both parties should keep a copy for their records. This agreement will guide the next steps in the real estate transaction process.