Free Texas residential property affidavit T-47 PDF Form

Misconceptions

The Texas residential property affidavit T-47 form is often misunderstood. Below are ten common misconceptions about this form, along with explanations to clarify each point.

- It is only for homeowners. The T-47 form is not limited to homeowners. It can also be used by sellers and buyers during real estate transactions to confirm property details.

- It is the same as a title policy. While the T-47 form provides information about the property, it is not a title policy. A title policy offers insurance against defects in title, whereas the T-47 is an affidavit that affirms certain facts about the property.

- It must be filed with the county clerk. The T-47 form does not need to be filed with the county clerk. Instead, it is typically provided to the title company handling the transaction.

- It is optional for all transactions. In many cases, the T-47 form is required by lenders or title companies to ensure that the property has not undergone significant changes that could affect its title.

- It only covers residential properties. Although primarily used for residential properties, the T-47 form can also apply to certain types of commercial properties, depending on the circumstances.

- It guarantees the accuracy of the information. The T-47 form does not guarantee the accuracy of the information provided. It is based on the affiant's knowledge and belief, and discrepancies may still exist.

- Anyone can complete the form. Typically, the form should be completed by the property owner or an authorized representative. This ensures that the information is accurate and reliable.

- It has no legal implications. The T-47 form is a legal document. Providing false information can have serious consequences, including potential legal action.

- It is a one-time requirement. Depending on the transaction and any changes to the property, the T-47 form may need to be completed multiple times or updated as necessary.

- It is only relevant in Texas. While the T-47 form is specific to Texas, similar affidavits may exist in other states. Each state has its own requirements and forms for property transactions.

What to Know About This Form

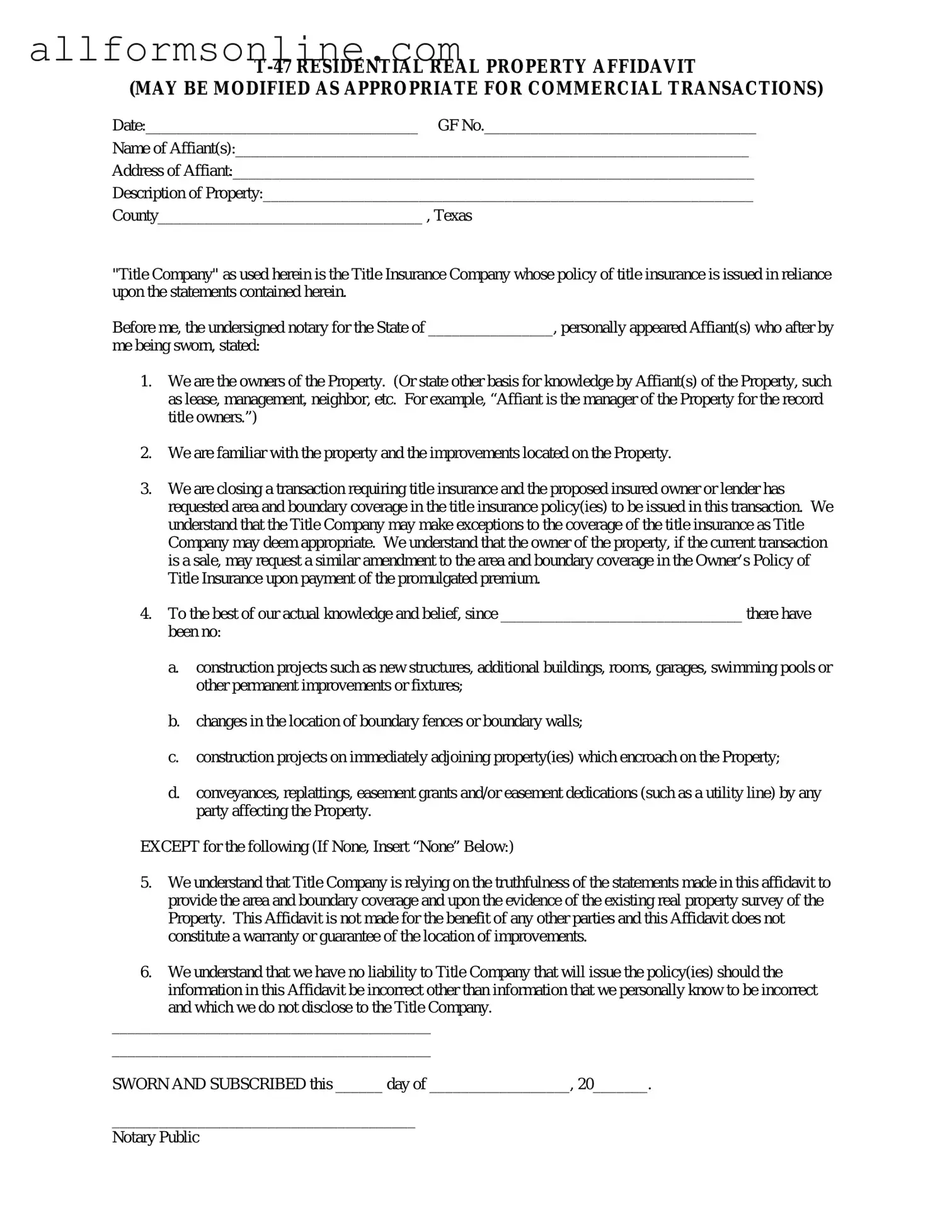

What is the Texas residential property affidavit T-47 form?

The Texas residential property affidavit T-47 form is a document used in real estate transactions. It serves to confirm the ownership and condition of a property, particularly when a lender requires evidence of the property’s status during the closing process. The form can help clarify any issues related to the property title.

Who needs to fill out the T-47 form?

The T-47 form is typically completed by the property owner or seller. It is often required by lenders or title companies to ensure that the property is free from liens or other encumbrances that could affect ownership rights.

When is the T-47 form required?

What information is included in the T-47 form?

The T-47 form includes details about the property, such as its legal description, the owner's name, and any known issues affecting the property. It may also require the owner to affirm that there are no outstanding liens or claims against the property.

How does the T-47 form affect the closing process?

The T-47 form can expedite the closing process by providing necessary information to the lender and title company. By confirming the property’s status, it helps to ensure that the transaction proceeds smoothly without delays related to title issues.

Is the T-47 form legally binding?

Yes, the T-47 form is a legally binding document. By signing it, the property owner affirms that the information provided is accurate. Misrepresentation on the form can lead to legal consequences, including potential liability for damages.

Can the T-47 form be modified?

While the T-47 form itself is standardized, the information contained within it can be modified to reflect the specifics of the property and the transaction. However, any changes should be made carefully and may require re-signing the document.

Where can I obtain a T-47 form?

The T-47 form can typically be obtained from title companies, real estate agents, or online legal document services. It is important to ensure that you are using the most current version of the form to comply with Texas regulations.

What should I do if I have questions about the T-47 form?

If you have questions about the T-47 form, consider consulting with a real estate attorney or a qualified title company. They can provide guidance on how to complete the form correctly and address any concerns you may have about its implications.

Can I use the T-47 form for commercial properties?

The T-47 form is specifically designed for residential properties. For commercial properties, different forms and affidavits may be required. Always check with your lender or title company for the appropriate documentation needed for commercial transactions.

Different PDF Forms

Snuggle Buddy Application - Find support and affection through cuddling.

For individuals seeking security in their estate planning, a thorough understanding of the necessary components of a Last Will and Testament can provide peace of mind. This form enables you to clearly delineate how your assets should be distributed and addresses key decisions regarding dependents, ensuring your wishes are respected after your passing.

Bill of Lading Form Pdf - Shippers can use a Straight Bill for both bulk and packaged goods.

Navpers 1336 3 - A thorough understanding of the rules surrounding leaves and pay benefits is helpful.

How to Use Texas residential property affidavit T-47

Filling out the Texas residential property affidavit T-47 form is an important step in documenting property ownership. Follow these steps carefully to ensure that all necessary information is accurately provided.

- Begin by obtaining a blank T-47 form. You can find this form online or at your local county clerk's office.

- At the top of the form, enter the name of the property owner. This should be the individual or entity that holds title to the property.

- Next, provide the address of the property. Include the street address, city, state, and ZIP code.

- In the designated section, indicate the legal description of the property. This information can usually be found on the property deed or tax records.

- Fill in the date of the affidavit. This should be the date you are completing the form.

- Sign the affidavit in the appropriate space. Make sure to use your legal name as it appears on the title.

- Have the affidavit notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed and notarized form for your records.

- Submit the original affidavit to the appropriate county office, typically the county clerk or property records office.

Once you have submitted the form, keep an eye out for any confirmation or additional requirements from the county office. It’s essential to ensure that your affidavit is processed correctly and promptly.