Attorney-Approved Tractor Bill of Sale Form for Texas

Misconceptions

When it comes to the Texas Tractor Bill of Sale form, several misconceptions can lead to confusion for buyers and sellers alike. Here are four common misunderstandings:

-

It’s only necessary for new tractors.

Many believe that a bill of sale is only needed for new tractors. In reality, whether the tractor is new or used, a bill of sale is essential for documenting the transaction and protecting both parties.

-

It doesn’t need to be notarized.

Some people think that notarization is optional. However, while notarization is not always required, having the document notarized can provide an extra layer of protection and legitimacy to the sale.

-

It’s a simple form that can be filled out quickly.

While the form may seem straightforward, providing accurate information is crucial. Mistakes or omissions can lead to legal issues down the line. Taking the time to complete it carefully is essential.

-

Once signed, it’s final and cannot be changed.

Many assume that once the bill of sale is signed, it cannot be altered. In fact, if both parties agree, changes can be made to the document. It’s important to keep communication open and document any amendments properly.

What to Know About This Form

What is a Texas Tractor Bill of Sale form?

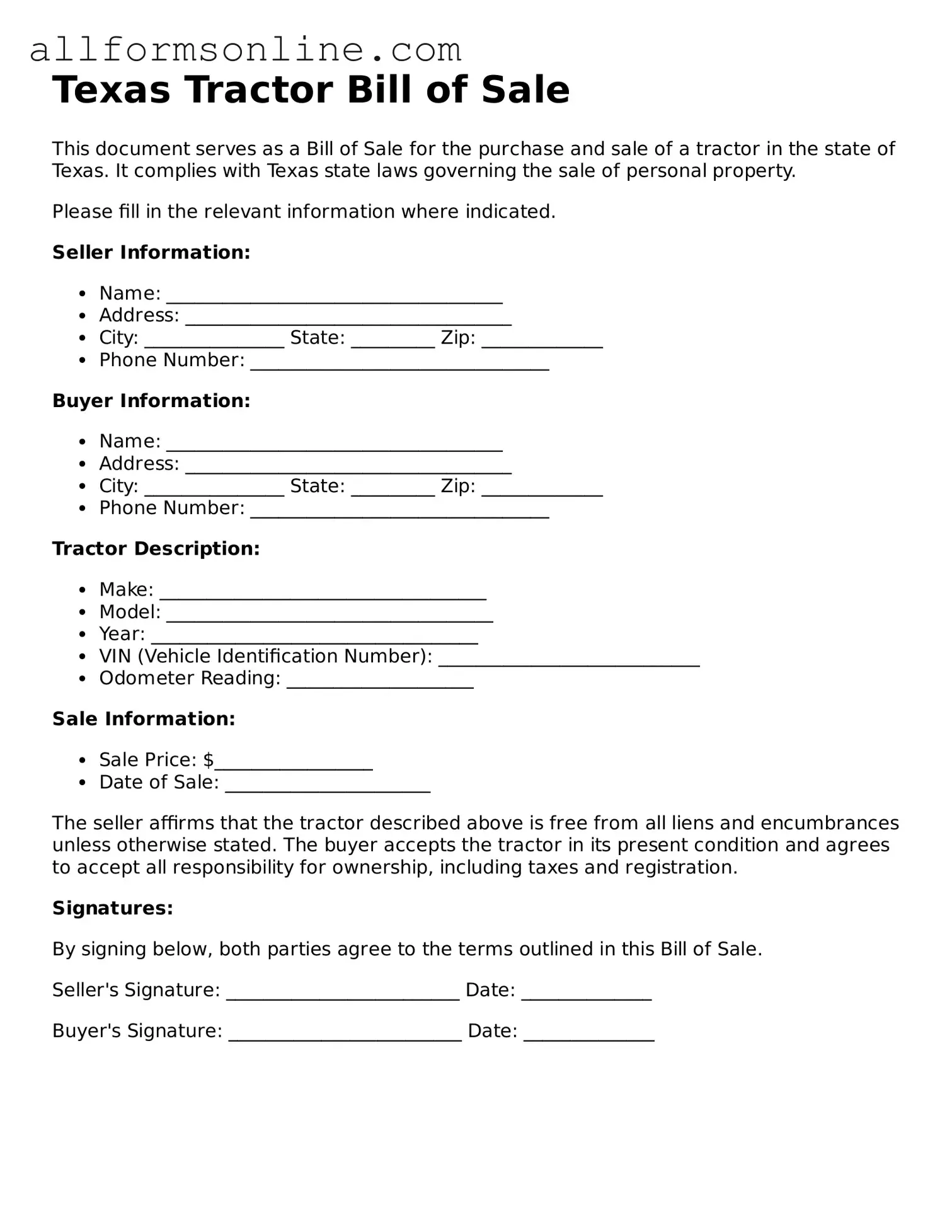

The Texas Tractor Bill of Sale form is a legal document that records the sale of a tractor between a buyer and a seller. This form provides essential details about the transaction, including the identification of the tractor, the purchase price, and the names and addresses of both parties involved. It serves as proof of ownership transfer and protects the rights of both the buyer and the seller.

Why is a Bill of Sale necessary when buying a tractor in Texas?

A Bill of Sale is crucial for several reasons. First, it provides a written record of the transaction, which can be useful for future reference. Second, it helps establish legal ownership, which is especially important if there are any disputes or questions about the sale. Additionally, having a Bill of Sale can simplify the process of registering the tractor with the Texas Department of Motor Vehicles (DMV) and can be necessary for tax purposes.

What information is typically included in the Texas Tractor Bill of Sale?

Typically, the Texas Tractor Bill of Sale includes the following information: the names and addresses of the buyer and seller, a detailed description of the tractor (including make, model, year, and Vehicle Identification Number or VIN), the purchase price, the date of sale, and any warranties or representations made by the seller. Both parties should sign and date the document to validate the agreement.

Do I need to have the Bill of Sale notarized?

In Texas, notarization of the Bill of Sale is not a legal requirement. However, having the document notarized can provide an extra layer of security and authenticity. It can help prevent disputes in the future by verifying the identities of the parties involved and the legitimacy of the transaction. While notarization is optional, it is often recommended for significant purchases like a tractor.

Can I create my own Texas Tractor Bill of Sale, or should I use a template?

You can create your own Texas Tractor Bill of Sale, but using a template is often advisable. Templates ensure that you include all necessary information and comply with any specific legal requirements. Many templates are readily available online and can be customized to fit your specific transaction. Whichever route you choose, ensure that the document is clear, complete, and accurately reflects the terms of the sale.

Other Common State-specific Tractor Bill of Sale Forms

Simple Bill of Sale Florida - Is an important part of a buyer’s record-keeping for insurance purposes.

Having a proper understanding of the vital Last Will and Testament guide for Georgia residents can significantly simplify the estate planning process, ensuring that your wishes are respected and fulfilled after your passing.

How to Use Texas Tractor Bill of Sale

Once you have the Texas Tractor Bill of Sale form in hand, it's time to fill it out accurately. This form is essential for documenting the sale of a tractor, ensuring both the buyer and seller have a clear record of the transaction. Follow these steps to complete the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the seller's name and address. This should include the street address, city, state, and zip code.

- Next, fill in the buyer's name and address using the same format as for the seller.

- In the designated section, include the tractor's make, model, and year. Ensure this information is accurate.

- Record the Vehicle Identification Number (VIN) of the tractor. This is crucial for identification purposes.

- Indicate the sale price of the tractor clearly. This should be the agreed-upon amount between the buyer and seller.

- Both the buyer and seller should sign and date the form at the bottom. This confirms that both parties agree to the terms outlined.

After completing the form, ensure that both parties retain a copy for their records. This documentation will be important for future reference, especially for registration or tax purposes.