Attorney-Approved Transfer-on-Death Deed Form for Texas

Misconceptions

Understanding the Texas Transfer-on-Death Deed (TODD) can be challenging. Many people hold misconceptions about this legal tool. Here are ten common misunderstandings:

- It only applies to real estate. While primarily used for real property, a TODD can also facilitate the transfer of certain types of personal property, depending on the situation.

- It is the same as a will. A TODD is not a will. It allows for the transfer of property outside of probate, whereas a will goes through the probate process.

- All properties can be transferred using a TODD. Not all types of property qualify. For instance, properties held in joint tenancy or those subject to a mortgage may have different considerations.

- It is irrevocable once signed. A TODD can be revoked or modified at any time before the death of the grantor, offering flexibility in estate planning.

- It automatically transfers upon signing. The transfer does not occur until the death of the grantor. Until then, the grantor retains full control over the property.

- Beneficiaries must accept the property. Beneficiaries can decline the inheritance, which can be beneficial in certain tax situations or personal circumstances.

- It eliminates all taxes. While a TODD may help avoid probate, it does not exempt the property from estate taxes or other potential liabilities.

- It is only for wealthy individuals. A TODD can be a useful tool for anyone wanting to simplify the transfer of property, regardless of their financial status.

- It requires a lawyer to create. While legal assistance can be helpful, individuals can fill out a TODD form themselves, provided they understand the requirements.

- Once filed, it cannot be changed. A TODD can be changed as long as the grantor is alive, allowing for adjustments as circumstances evolve.

By clarifying these misconceptions, individuals can make informed decisions about using the Texas Transfer-on-Death Deed as part of their estate planning strategy.

What to Know About This Form

What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner in Texas to designate a beneficiary who will receive the property upon the owner’s death. This deed enables the transfer of real estate without the need for probate, simplifying the process for heirs and ensuring that the property passes directly to them.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Texas can utilize a Transfer-on-Death Deed. This includes single owners, married couples, and individuals who own property in a trust. However, it is important to ensure that the deed is executed properly to be valid.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, the property owner must fill out the appropriate form, which includes information about the property and the designated beneficiary. The owner must then sign the deed in front of a notary public. After that, the deed must be recorded in the county where the property is located to be effective.

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the owner’s death. To do this, the owner must execute a new deed or a revocation form and ensure it is properly recorded. It is advisable to consult with a legal professional to ensure that the changes are valid and recorded correctly.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed becomes ineffective regarding that beneficiary. The property owner may then choose to designate a new beneficiary or decide to let the property pass according to their will or Texas intestacy laws if there is no will.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. However, the property may be subject to estate taxes upon the owner's death, and the beneficiary may face property taxes once they inherit the property. It is recommended to consult a tax advisor for specific guidance.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both documents deal with the transfer of property upon death, a TODD allows for direct transfer of property without going through probate. A will, on the other hand, must be validated in probate court, which can be a lengthy process.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can only be used for real estate, such as residential or commercial property. It cannot be used for personal property, bank accounts, or other assets. For those types of assets, different estate planning tools may be necessary.

Other Common State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Florida Form - Property owners can consult with legal professionals to determine if a Transfer-on-Death Deed is suitable for their situation.

The EDD DE 2501 form is a crucial document used in California to apply for Disability Insurance benefits. This form acts as a formal request for financial support during a period of temporary disability. Completing the DE 2501 accurately can significantly impact eligibility and the timely receipt of benefits. For those looking for assistance with the process, resources such as Fast PDF Templates can be invaluable.

Avoiding Probate in California - Beneficiaries can be individuals or entities, providing flexibility in property transfer choices.

How to Use Texas Transfer-on-Death Deed

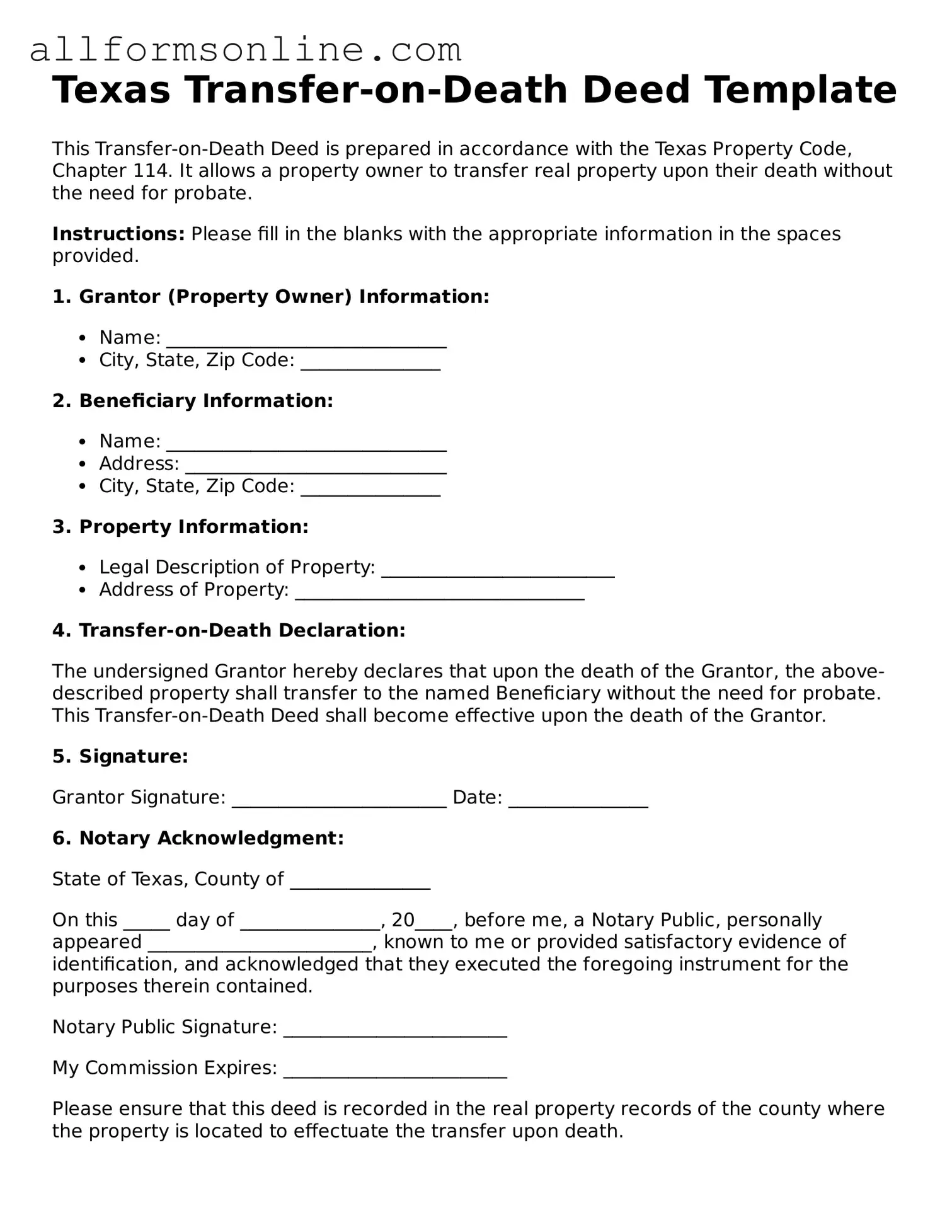

After obtaining the Texas Transfer-on-Death Deed form, it is important to fill it out accurately to ensure that your intentions are clearly documented. Following the steps outlined below will help in completing the form correctly.

- Begin by entering the name of the current property owner(s) at the top of the form. This should include all individuals who hold title to the property.

- Provide the address of the property being transferred. Ensure that this information is complete and accurate.

- Next, specify the name of the beneficiary or beneficiaries who will receive the property upon the owner's death. Include their full names and relationship to the owner.

- Include any specific instructions regarding the transfer, if applicable. This may involve conditions or limitations on the transfer.

- Sign and date the form in the designated area. All property owners must sign the document.

- Have the form notarized. This step is crucial for the deed to be legally binding.

- Finally, file the completed deed with the county clerk's office in the county where the property is located. Ensure that you keep a copy for your records.