Blank Transfer-on-Death Deed Form

Transfer-on-Death DeedDocuments for Particular States

Misconceptions

Understanding the Transfer-on-Death Deed can be crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are five common misunderstandings about this important legal tool:

-

It automatically transfers property upon death.

Many believe that a Transfer-on-Death Deed instantly transfers property to the beneficiary when the owner passes away. In reality, the deed only takes effect after the owner's death, and the beneficiary must still go through the necessary legal processes to claim the property.

-

All types of property can be transferred using this deed.

Some people think that any property can be transferred with a Transfer-on-Death Deed. However, this option is typically limited to real estate. Personal property, such as vehicles or bank accounts, usually requires different forms of transfer.

-

It eliminates the need for a will.

There is a common belief that using a Transfer-on-Death Deed means a will is no longer necessary. While this deed can simplify the transfer of specific properties, it does not replace the need for a comprehensive will that addresses all aspects of an estate.

-

Beneficiaries cannot be changed once named.

Some individuals think that once a beneficiary is named on a Transfer-on-Death Deed, that choice is final. In fact, the property owner retains the right to change beneficiaries or revoke the deed entirely at any time before their death.

-

This deed avoids all taxes and fees.

Many assume that a Transfer-on-Death Deed allows beneficiaries to avoid all taxes and fees associated with the property transfer. While it can help bypass probate, it does not exempt the property from potential estate taxes or other fees that may apply.

By clarifying these misconceptions, individuals can make informed decisions about their estate planning needs. A well-thought-out approach can lead to peace of mind for both the property owner and their loved ones.

What to Know About This Form

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate property to a designated beneficiary upon the individual's death. This deed provides a way to avoid probate, simplifying the transfer process for heirs.

Who can create a Transfer-on-Death Deed?

Any property owner who is legally competent can create a Transfer-on-Death Deed. This includes individuals who hold title to real estate and wish to designate a beneficiary to receive the property after their death.

What types of property can be transferred using a Transfer-on-Death Deed?

Typically, a Transfer-on-Death Deed can be used for residential real estate, such as single-family homes, condominiums, and vacant land. However, it cannot be used for personal property like vehicles or bank accounts.

How does a Transfer-on-Death Deed work?

The property owner fills out the Transfer-on-Death Deed form, naming one or more beneficiaries. After the owner's death, the property automatically transfers to the beneficiaries without going through probate, as long as the deed was properly executed and recorded.

Do I need to notify the beneficiary about the Transfer-on-Death Deed?

While it is not legally required to inform the beneficiary, it is advisable to do so. Informing the beneficiary can help avoid confusion or disputes after the owner's death, ensuring that the intended recipient is aware of the arrangement.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. The property owner must execute a new deed that explicitly revokes the previous one, or they can record a formal revocation document. It is important to follow the appropriate legal procedures to ensure the revocation is valid.

Are there any limitations to using a Transfer-on-Death Deed?

Yes, there are some limitations. A Transfer-on-Death Deed does not apply to all types of property and may not be recognized in all states. Additionally, if the property owner has outstanding debts or liens, creditors may still have claims against the property after the owner's death.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the transfer may become void unless the deed includes an alternate beneficiary. It is essential to consider this possibility and name contingent beneficiaries to ensure the property is transferred as intended.

Is legal assistance recommended when creating a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting an attorney is recommended. An attorney can provide guidance on the specific requirements of your state and help ensure that the deed is properly executed and recorded.

Popular Transfer-on-Death Deed Types:

Correction Deed California - Filing a Corrective Deed can prevent potential title insurance claims from errors.

How to File a Lady Bird Deed in Michigan - Families can avoid lengthy and expensive court processes with the timely transfer allowed by a Lady Bird Deed.

The California Trailer Bill of Sale form is an essential document used to officially transfer ownership of a trailer from one party to another. This form provides important details about the transaction, including information about the buyer, seller, and the trailer itself. For those looking to create a comprehensive and accurate bill of sale, resources like Fast PDF Templates can be invaluable, ensuring a smooth and legal transfer process.

Quitclaim Deed Form New Jersey - Especially useful when transferring family-owned real estate.

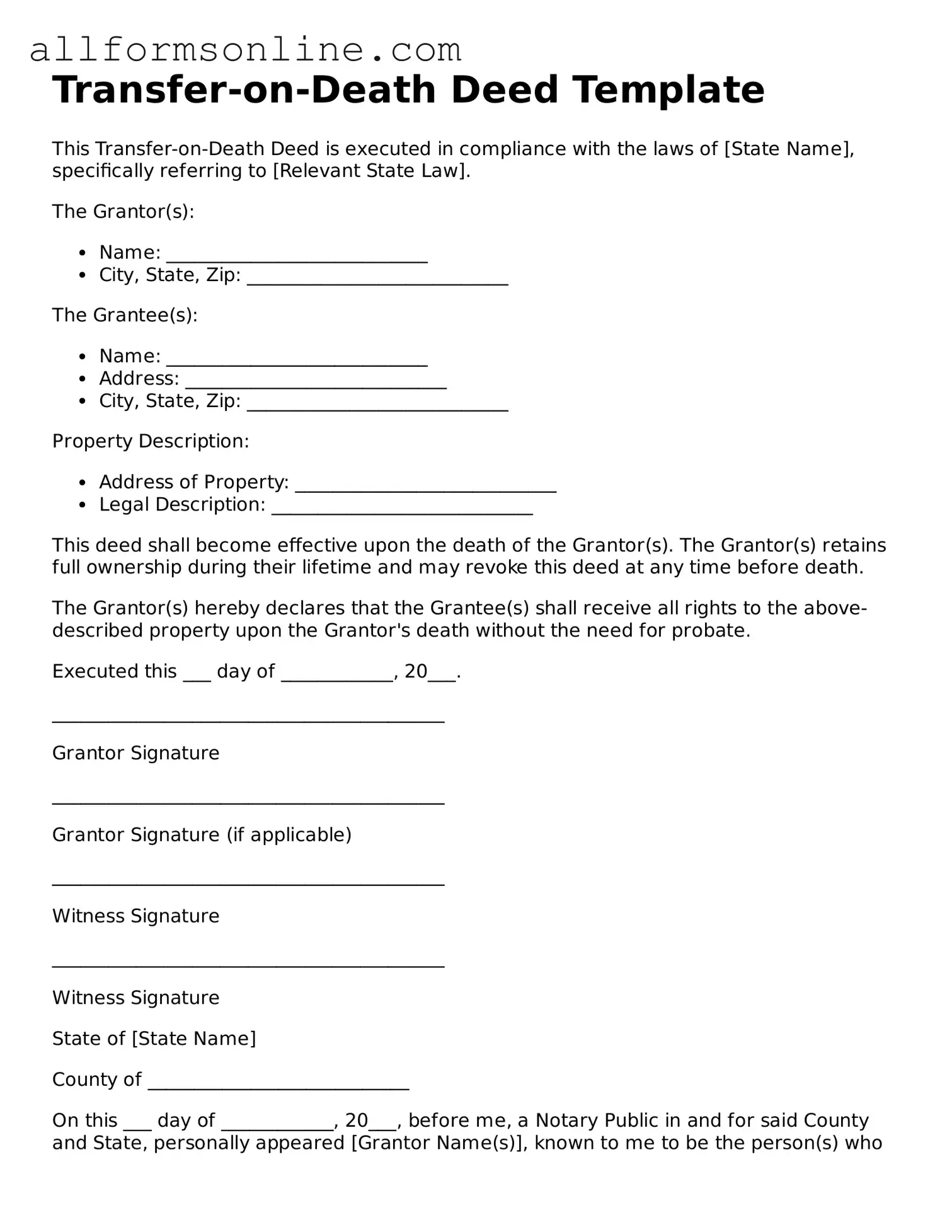

How to Use Transfer-on-Death Deed

After obtaining the Transfer-on-Death Deed form, it is essential to complete it accurately to ensure that the transfer of property is executed as intended. Follow the steps below to fill out the form properly.

- Begin by entering the name of the property owner(s) in the designated section. Include all relevant names exactly as they appear on the property title.

- Provide the address of the property being transferred. This should include the street address, city, state, and zip code.

- Identify the legal description of the property. This information can typically be found on the property deed or tax records. Ensure it is complete and accurate.

- Next, list the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner's death. Include their full names and relationship to the owner, if applicable.

- Specify whether the transfer is to be made to multiple beneficiaries. If so, indicate how the property will be divided among them.

- Sign the form in the presence of a notary public. Ensure that all property owners sign, as required.

- Have the notary public complete their section, confirming that the signatures are valid and witnessing the signing process.

- Finally, file the completed and notarized form with the appropriate county office where the property is located. Check for any filing fees that may apply.