Blank Vehicle Repayment Agreement Form

Misconceptions

When dealing with the Vehicle Repayment Agreement form, many misunderstandings can arise. Here are eight common misconceptions, along with clarifications to help you better understand this important document.

-

The form is only for people with bad credit.

This is not true. The Vehicle Repayment Agreement can be used by anyone who is financing a vehicle, regardless of their credit history. It's a tool to outline the terms of repayment.

-

You must have a lawyer to complete the form.

While legal advice can be beneficial, it is not a requirement to fill out the Vehicle Repayment Agreement. Individuals can complete the form on their own if they understand the terms.

-

The agreement is not legally binding.

This is a misconception. The Vehicle Repayment Agreement is a legally binding document once both parties sign it, meaning that it can be enforced in court if necessary.

-

You can ignore the terms if you change your mind.

Once signed, the terms of the agreement must be followed. Ignoring the terms can lead to serious consequences, including repossession of the vehicle.

-

All Vehicle Repayment Agreements are the same.

This is incorrect. Each agreement can vary based on the lender, the borrower, and specific terms negotiated. It is important to read and understand your own agreement.

-

You cannot make changes to the agreement after signing.

While it can be challenging, changes can be made if both parties agree to the modifications. It is essential to document any changes properly.

-

The form is only necessary for new vehicles.

This is a misconception as well. The Vehicle Repayment Agreement is applicable for both new and used vehicles that are being financed.

-

You don’t need to keep a copy of the agreement.

It is crucial to keep a copy of the signed agreement for your records. This document serves as proof of the terms you agreed to and can be referenced in case of disputes.

What to Know About This Form

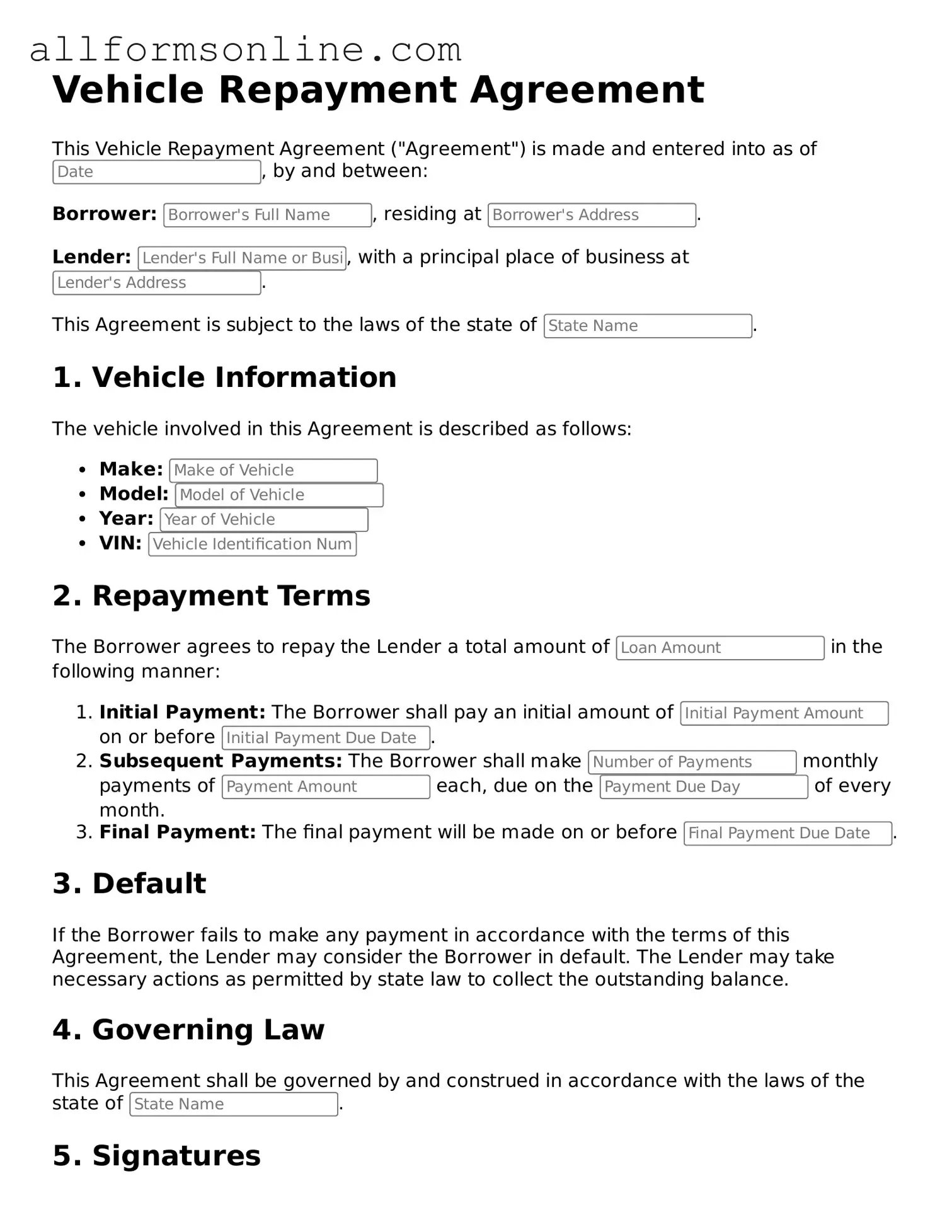

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a legal document that outlines the terms under which a borrower agrees to repay a loan used to finance a vehicle. It details the loan amount, interest rate, payment schedule, and any penalties for late payments. This form protects both the lender and the borrower by clearly stating the obligations and rights of each party involved in the transaction.

Who needs to complete the Vehicle Repayment Agreement form?

Anyone who is borrowing money to purchase a vehicle should complete this form. This includes individuals, businesses, or organizations that enter into a financing arrangement with a lender. Completing the form is essential to ensure that all parties understand the repayment terms and conditions before finalizing the loan.

What information is required on the Vehicle Repayment Agreement form?

The form typically requires personal information from the borrower, including name, address, and contact details. It also includes details about the vehicle, such as make, model, year, and Vehicle Identification Number (VIN). Financial information like the loan amount, interest rate, repayment schedule, and any fees or penalties should also be included to provide a complete picture of the agreement.

What happens if I miss a payment outlined in the Vehicle Repayment Agreement?

If a payment is missed, the lender may impose penalties as specified in the agreement. This could include late fees or an increase in the interest rate. In some cases, the lender may have the right to repossess the vehicle. It is crucial to communicate with the lender as soon as possible if a payment cannot be made on time to discuss potential solutions.

Can the terms of the Vehicle Repayment Agreement be modified?

Popular Templates:

Free Printable Five Wishes Pdf - Five Wishes helps guide your loved ones during difficult moments, offering clarity and direction.

Obtaining your Texas Certificate of Insurance is essential for compliance and protection; for more detailed guidance on how to fill it out, visit texasformspdf.com/fillable-texas-certificate-insurance-online/ to streamline the process and ensure you meet all the requirements set forth by the Texas State Board of Plumbing Examiners.

Fake Dr Note - A brief health document used to communicate with employers or educators about absence.

How to Use Vehicle Repayment Agreement

After you have gathered all necessary information, you are ready to fill out the Vehicle Repayment Agreement form. Completing this form accurately is essential for ensuring that your repayment terms are clearly understood and agreed upon. Follow the steps below to fill out the form correctly.

- Start with your personal information. Fill in your full name, address, and contact details at the top of the form.

- Provide the vehicle details. Enter the make, model, year, and Vehicle Identification Number (VIN) of the vehicle.

- Indicate the loan amount. Clearly state the total amount you are agreeing to repay.

- Specify the repayment terms. Include the repayment schedule, such as the number of payments and the frequency (weekly, bi-weekly, or monthly).

- Fill in the interest rate. If applicable, enter the interest rate that will be charged on the loan amount.

- Sign and date the form. Ensure that you sign where indicated and include the date of signing.

- Review the completed form. Double-check all entries for accuracy before submission.

Once the form is filled out, submit it according to the instructions provided. Keep a copy for your records, and ensure you understand the terms before proceeding.